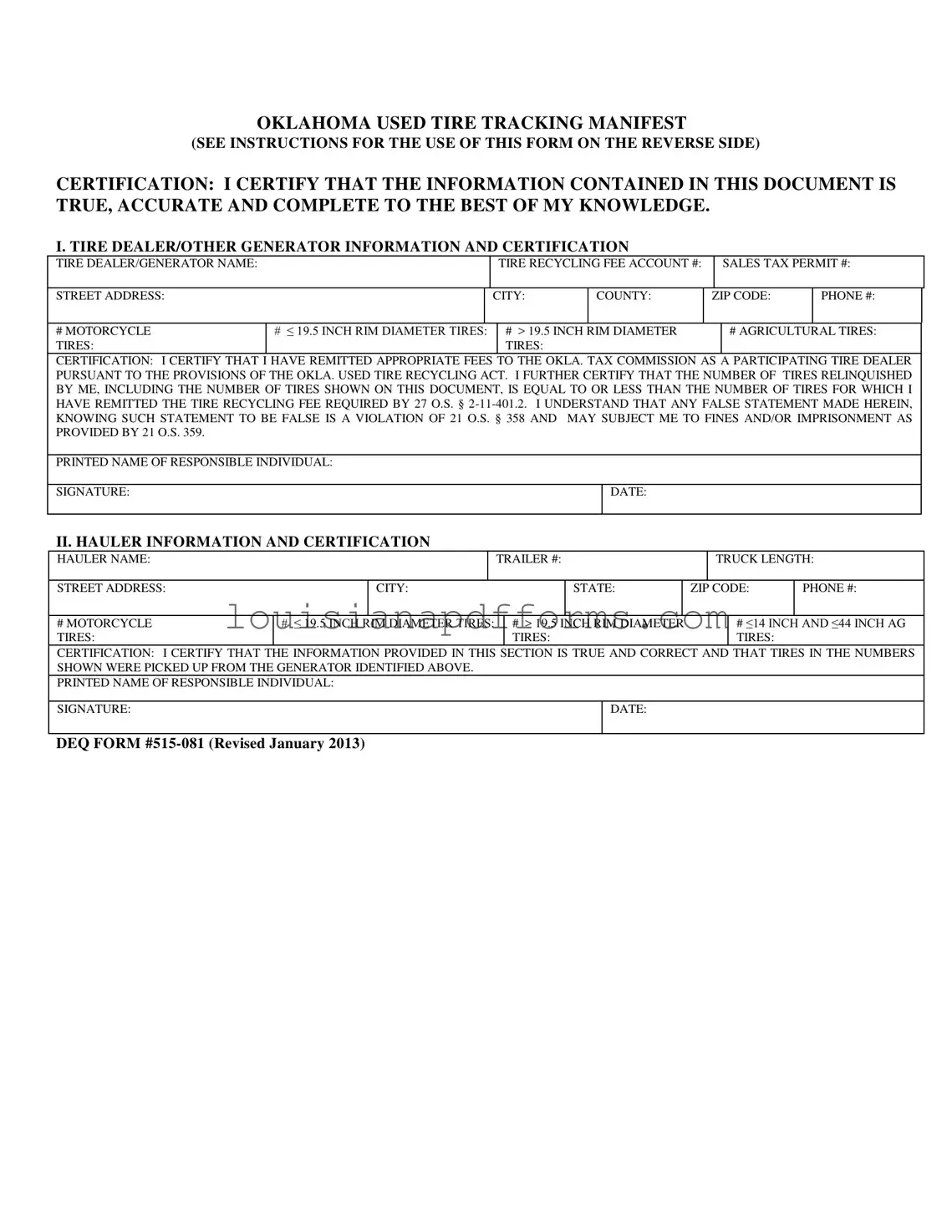

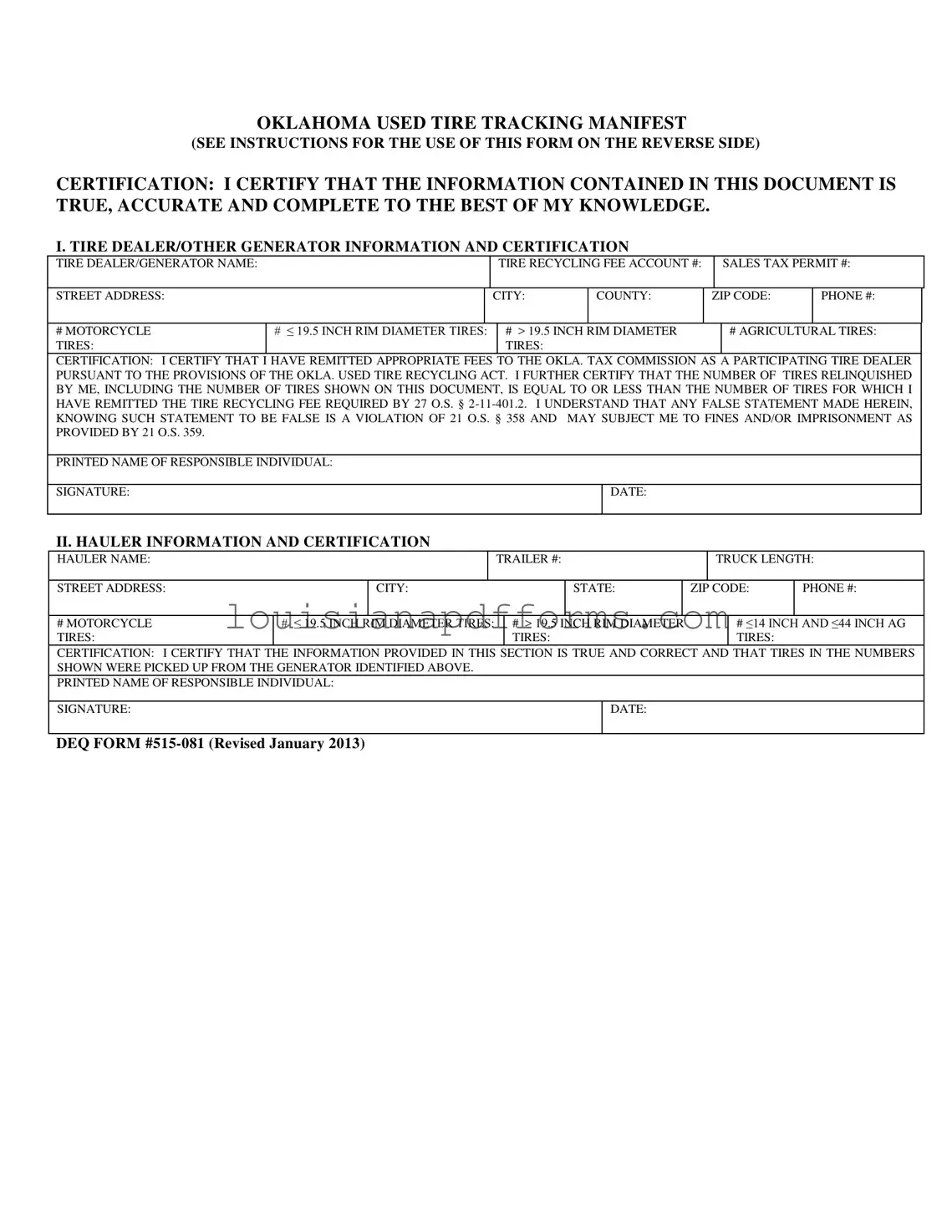

The DEQ 515 081 form, also known as the Oklahoma Used Tire Tracking Manifest, is designed to track the movement of used tires. This form ensures compliance with state regulations regarding the recycling and disposal of tires, facilitating proper documentation for tire dealers, generators, and haulers.

The form must be completed by both tire dealers or generators and haulers. Tire dealers or generators fill out Section I, while haulers complete Section II. Each party involved in the tire transfer process has a responsibility to ensure accurate information is recorded.

Section I requires the following information:

-

Tire dealer or generator name

-

Tire recycling fee account number

-

Sales tax permit number

-

Street address, city, county, and ZIP code

-

Phone number

-

Counts of various tire types, including motorcycles, agricultural tires, and those with different rim diameters

This information is essential for tracking and regulatory purposes.

What does the certification section entail?

The certification section requires the responsible individual to attest that the information provided is accurate and complete. It also confirms that appropriate fees have been remitted to the Oklahoma Tax Commission and that the number of tires relinquished matches the fees paid. Any false statement can result in legal penalties.

In Section II, the hauler must provide similar details, including:

-

Hauler name

-

Trailer number

-

Truck length

-

Street address, city, state, and ZIP code

-

Phone number

-

Counts of tires picked up, categorized by type

This information is crucial for tracking the movement of tires from generators to recycling facilities.

Once the form is completed, a copy must be provided to the generator. If applicable, another copy should accompany the used tire reimbursement manifest when tires are picked up and delivered to a recycling facility. The primary hauler or final recipient must retain a copy for their records.

All parties involved in the tire transfer must keep their copies of the manifest for a minimum of five years. This retention period is critical for compliance and potential audits.

Yes, manifests must be printed on the appropriate forms as outlined in OAC 252:515-21-51. It is important to follow these guidelines to ensure compliance with state regulations. Color coding is optional but can be used for organizational purposes.

If the form is not completed accurately, it may lead to compliance issues with state regulations. Inaccurate information can result in penalties for the responsible parties, including fines or legal action. Therefore, careful attention should be paid to the completion of the form.