What is a Louisiana Durable Power of Attorney?

A Louisiana Durable Power of Attorney is a legal document that allows an individual (the principal) to appoint someone else (the agent) to make decisions on their behalf. This authority remains effective even if the principal becomes incapacitated. It is particularly useful for managing financial and legal matters when the principal is unable to do so themselves.

Why should I create a Durable Power of Attorney?

Creating a Durable Power of Attorney is essential for ensuring that your financial and legal affairs are handled according to your wishes if you become incapacitated. It provides peace of mind, knowing that someone you trust will make decisions for you. Additionally, it can help avoid the need for court intervention, which can be time-consuming and costly.

Who can be my agent?

Your agent can be anyone you trust to act in your best interest. This can include family members, friends, or even professionals like attorneys or financial advisors. However, it is important to choose someone who is responsible and capable of handling your affairs. In Louisiana, the agent must be at least 18 years old and mentally competent.

What powers can I grant to my agent?

You can grant your agent a wide range of powers, including but not limited to:

-

Managing bank accounts

-

Buying or selling property

-

Paying bills

-

Making investment decisions

-

Handling tax matters

It's crucial to clearly outline the specific powers you wish to grant in the document. This ensures that your agent knows their authority and can act accordingly.

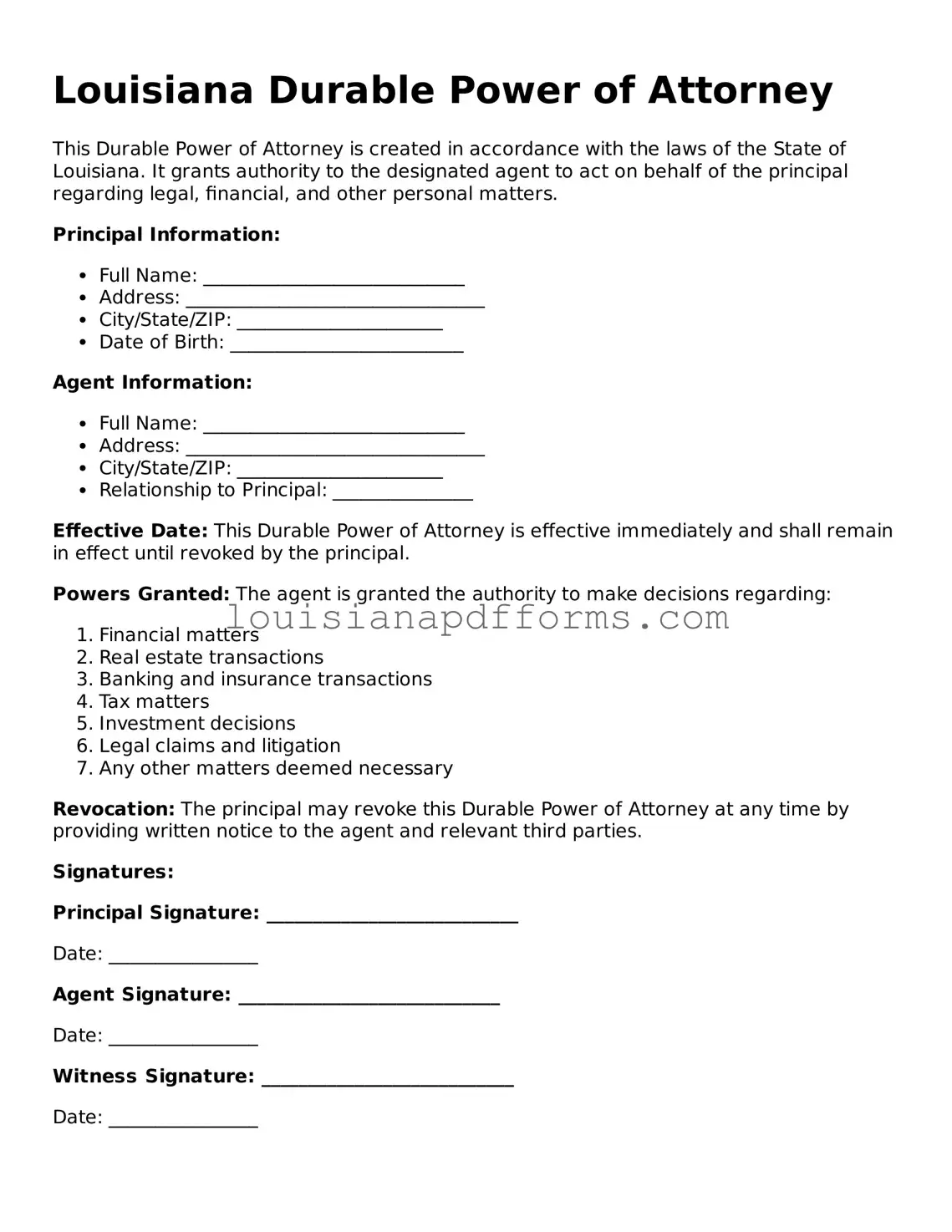

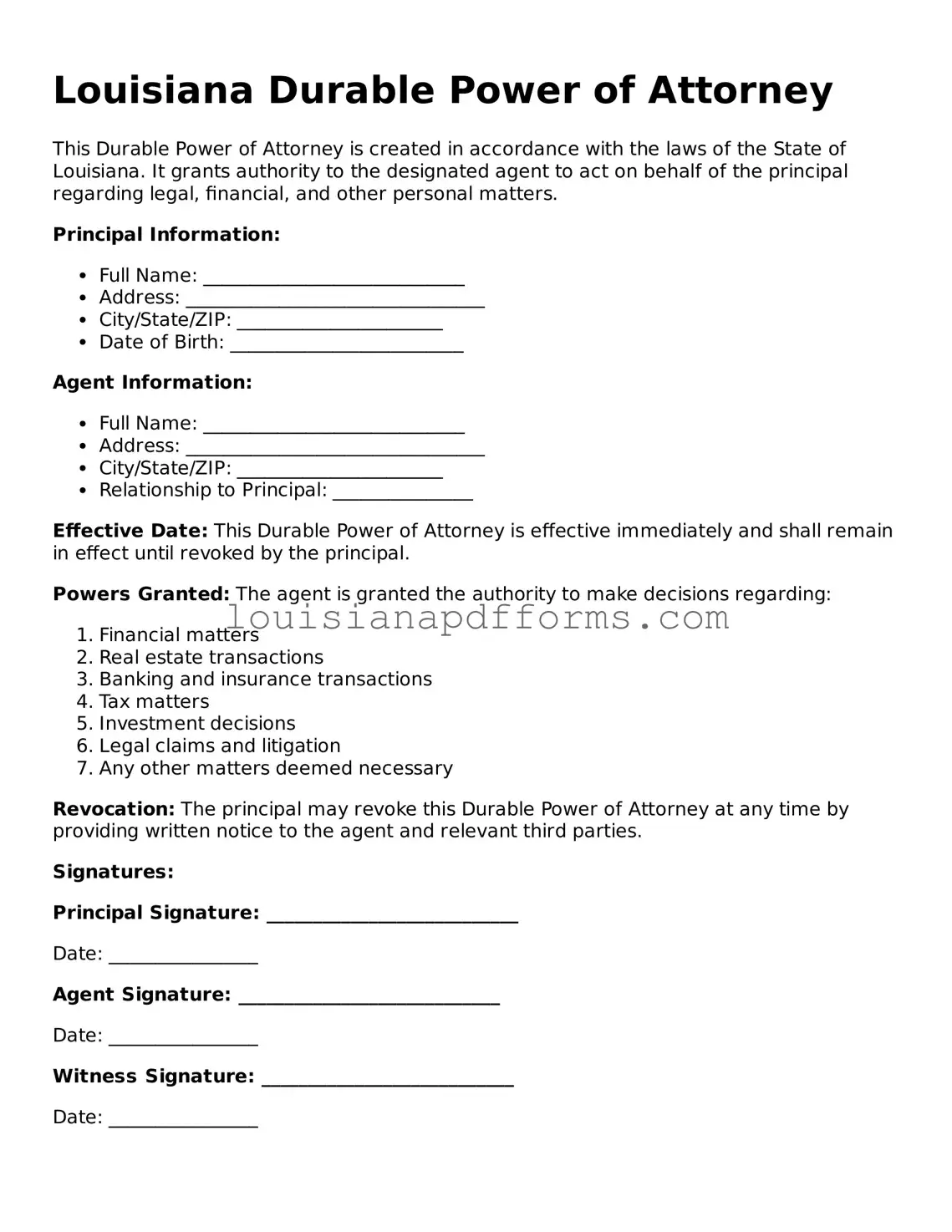

How do I create a Durable Power of Attorney in Louisiana?

To create a Durable Power of Attorney in Louisiana, you must follow these steps:

-

Choose your agent carefully.

-

Draft the Durable Power of Attorney document, ensuring it complies with Louisiana law.

-

Sign the document in the presence of a notary public.

-

Consider having witnesses sign the document, although this is not required.

Once completed, provide copies to your agent and any relevant financial institutions or healthcare providers.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a Durable Power of Attorney at any time as long as you are mentally competent. To do this, you should create a written revocation document and notify your agent and any relevant institutions. It’s advisable to also retrieve any copies of the original Durable Power of Attorney to prevent confusion.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, your loved ones may need to go through a court process to obtain guardianship or conservatorship. This process can be lengthy, costly, and may not align with your personal wishes. Having a Durable Power of Attorney in place avoids this situation and allows you to maintain control over your affairs.

Is a Durable Power of Attorney the same as a Healthcare Power of Attorney?

No, a Durable Power of Attorney primarily deals with financial and legal matters, while a Healthcare Power of Attorney specifically grants authority to make medical decisions on your behalf. It’s advisable to have both documents to ensure comprehensive coverage of your needs in case of incapacity.

Do I need a lawyer to create a Durable Power of Attorney?

While it is not legally required to have a lawyer, consulting one can be beneficial. A lawyer can help ensure that the document is properly drafted, complies with Louisiana laws, and accurately reflects your wishes. If your situation is complex, such as involving significant assets or family dynamics, professional guidance is highly recommended.