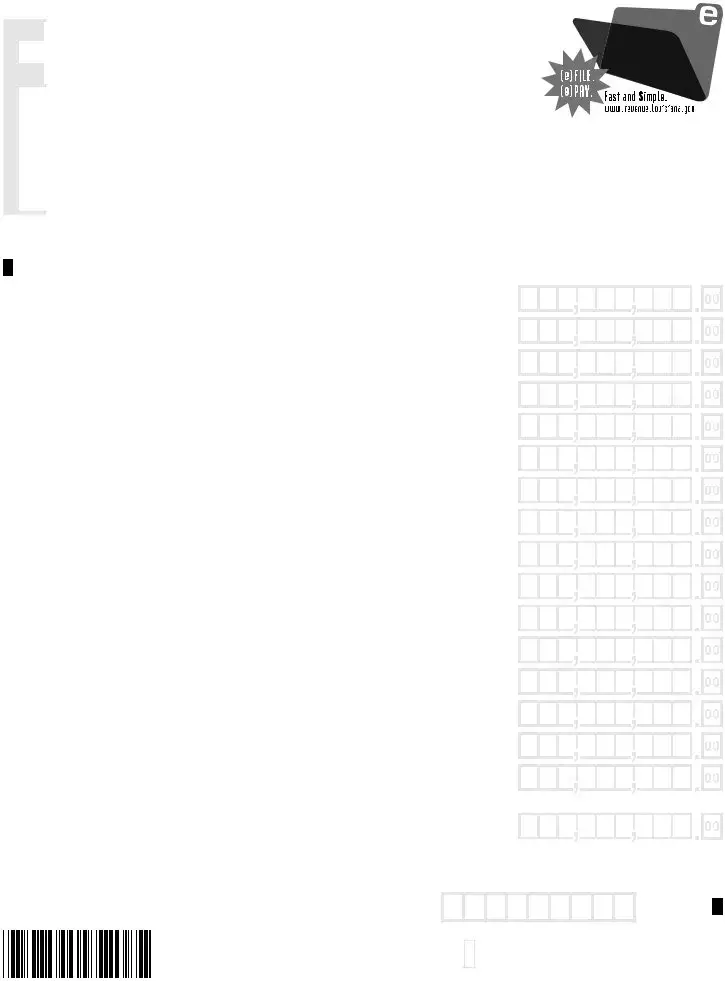

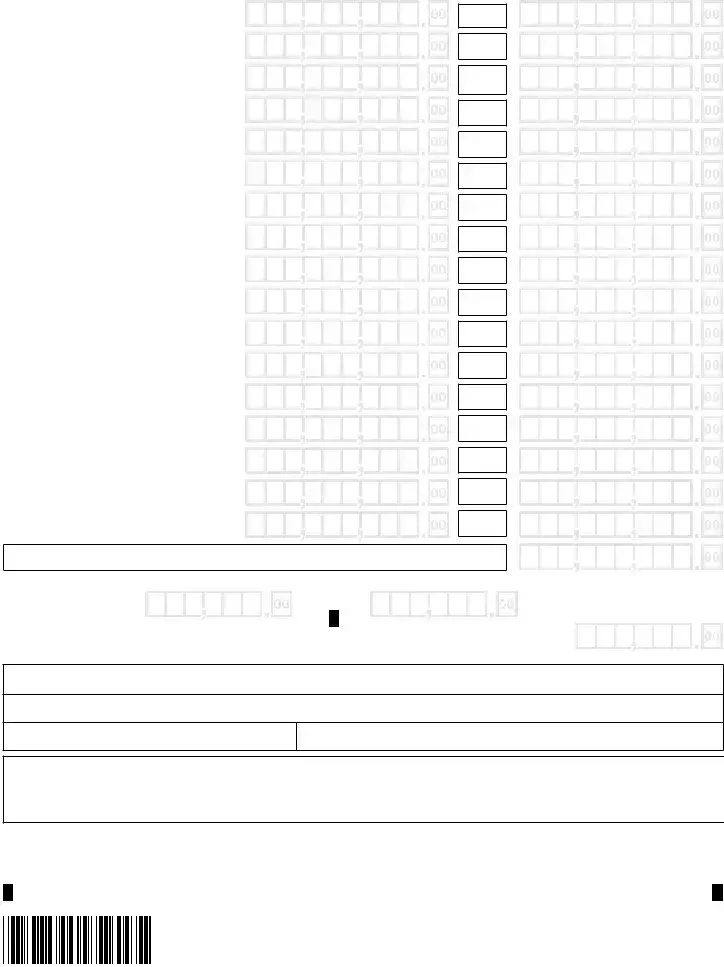

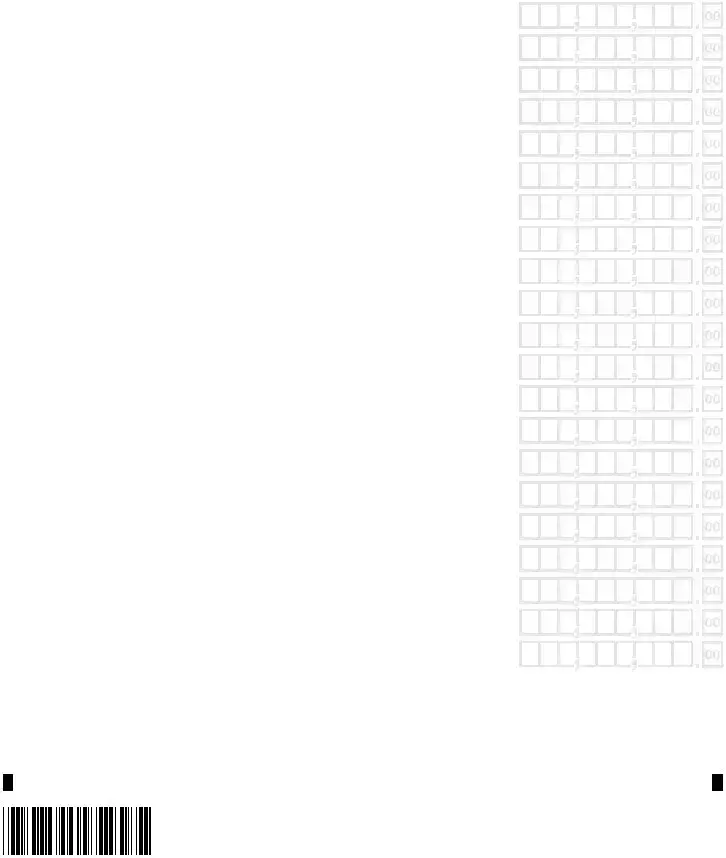

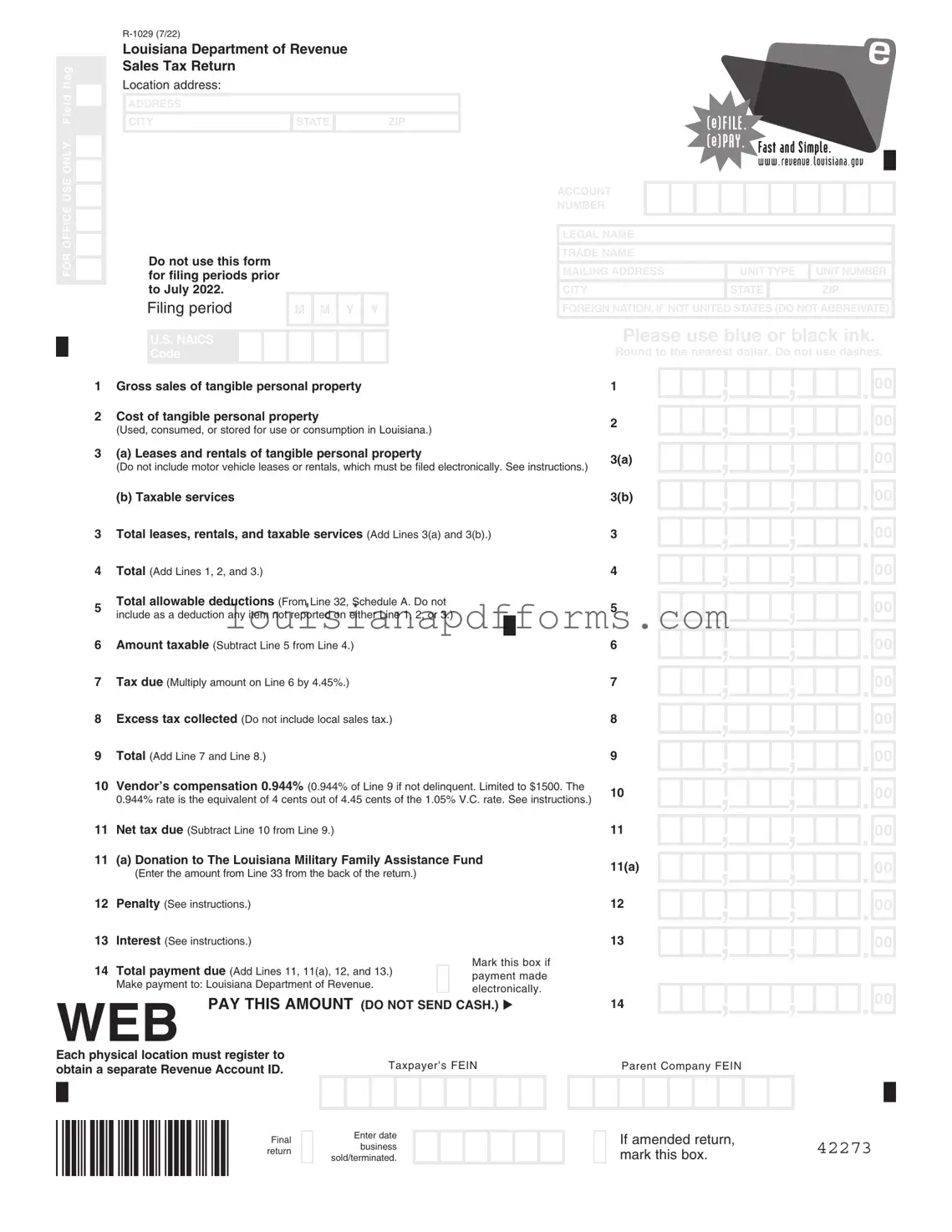

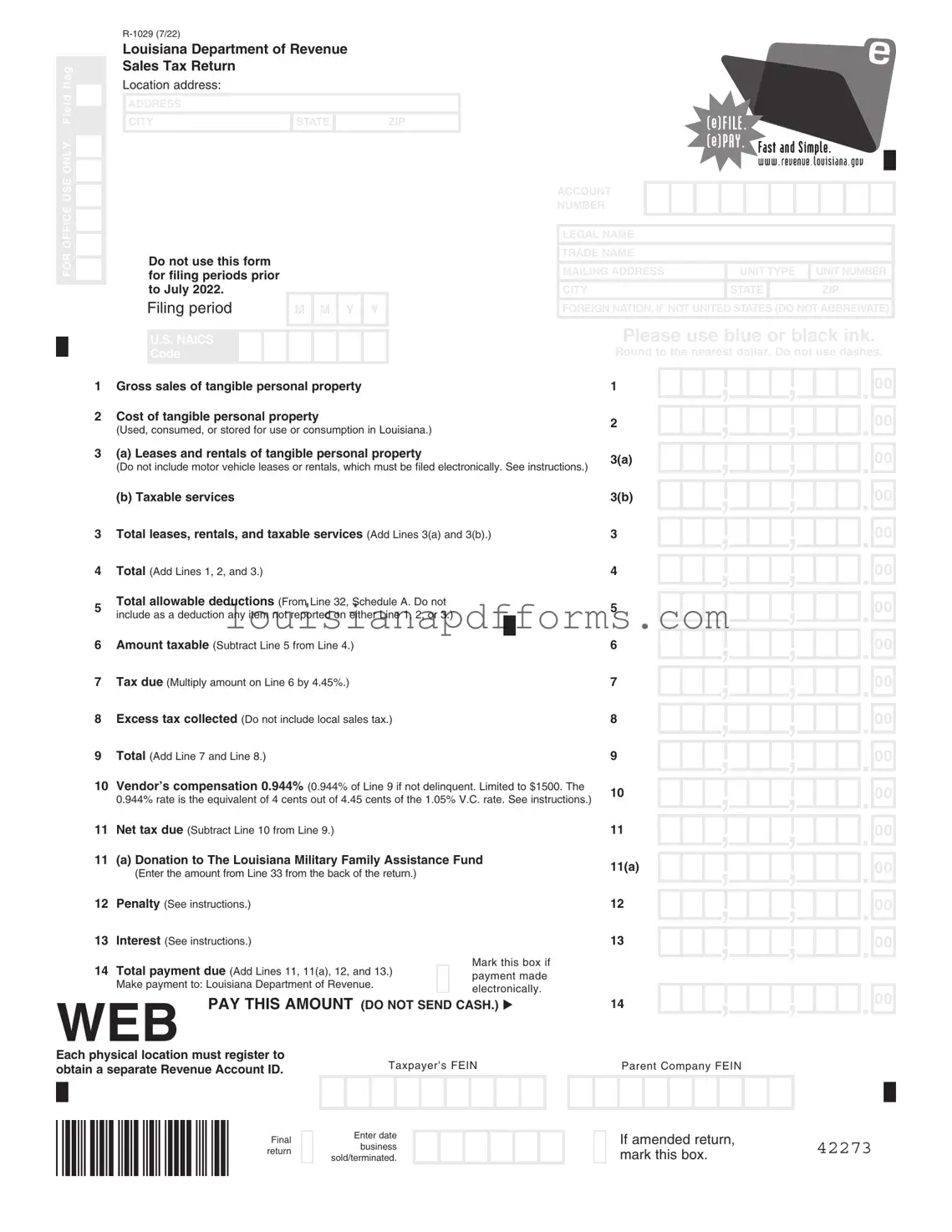

Blank Louisiana 1029 Sales PDF Form

The Louisiana 1029 Sales form is a tax return document used by businesses in Louisiana to report sales tax on tangible personal property and certain services. This form is specifically designed for filing periods starting from August 2020 and is essential for ensuring compliance with state tax regulations. Understanding how to accurately complete the Louisiana 1029 Sales form can help businesses avoid penalties and streamline their tax reporting process.

Access My Document Now

Blank Louisiana 1029 Sales PDF Form

Access My Document Now

Access My Document Now

or

Free Louisiana 1029 Sales

You’re halfway through — finish the form

Edit, save, and download your completed Louisiana 1029 Sales online.