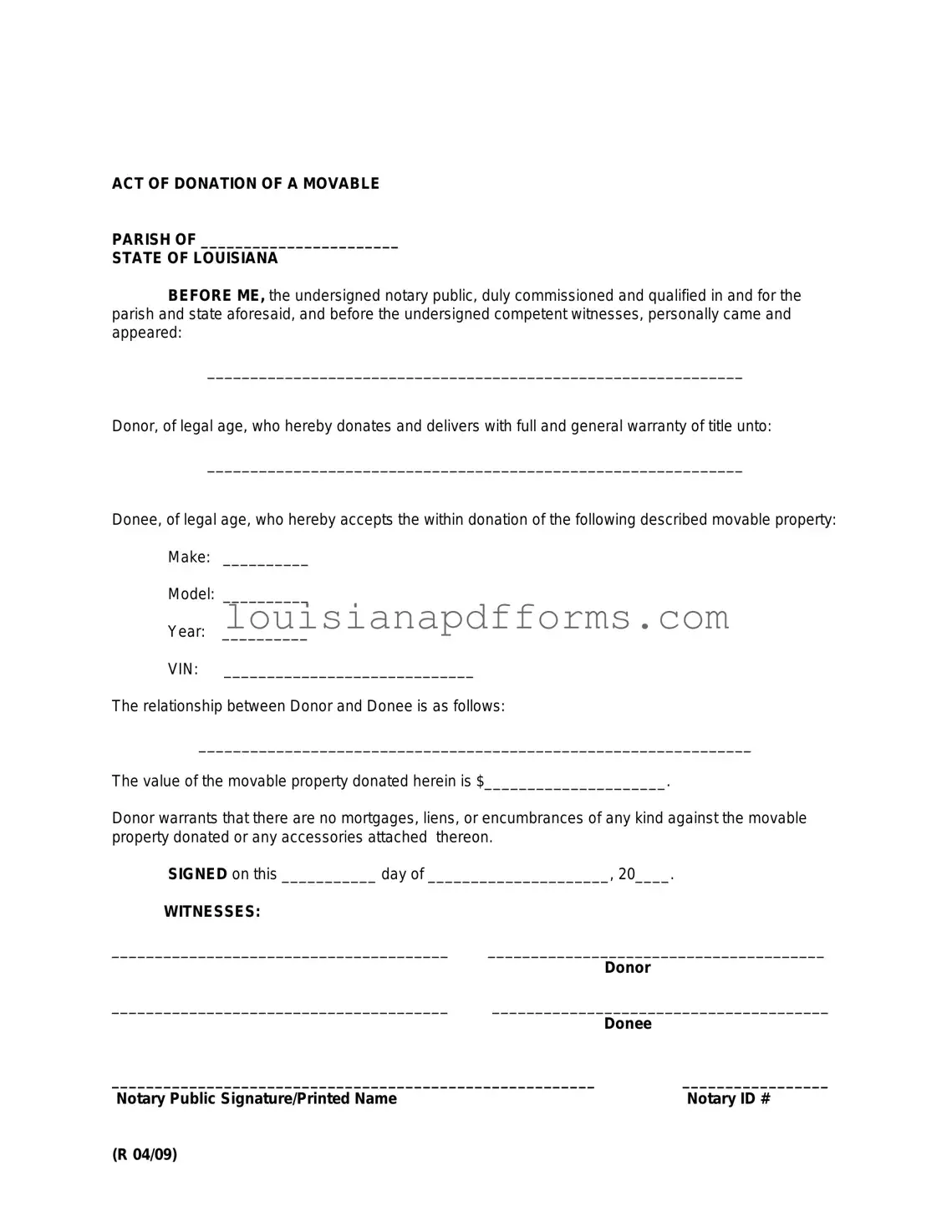

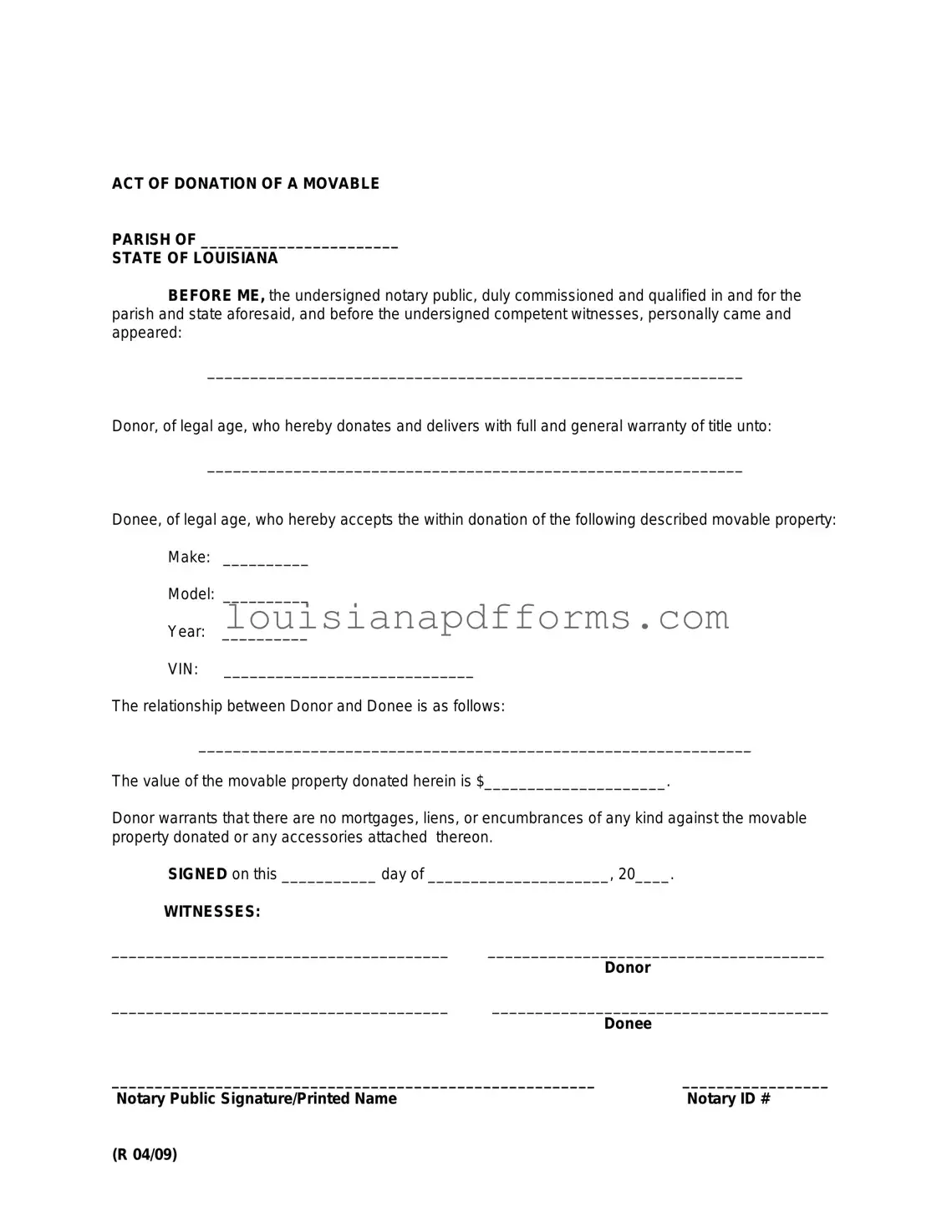

Blank Louisiana act of donation PDF Form

The Louisiana Act of Donation Form is a legal document used to transfer ownership of property or assets from one person to another without any payment involved. This form is essential for ensuring that the donation is recognized and recorded properly under Louisiana law. Understanding how to fill out this form correctly can help avoid future disputes and ensure that your intentions are honored.

Access My Document Now

Blank Louisiana act of donation PDF Form

Access My Document Now

Access My Document Now

or

Free Louisiana act of donation

You’re halfway through — finish the form

Edit, save, and download your completed Louisiana act of donation online.