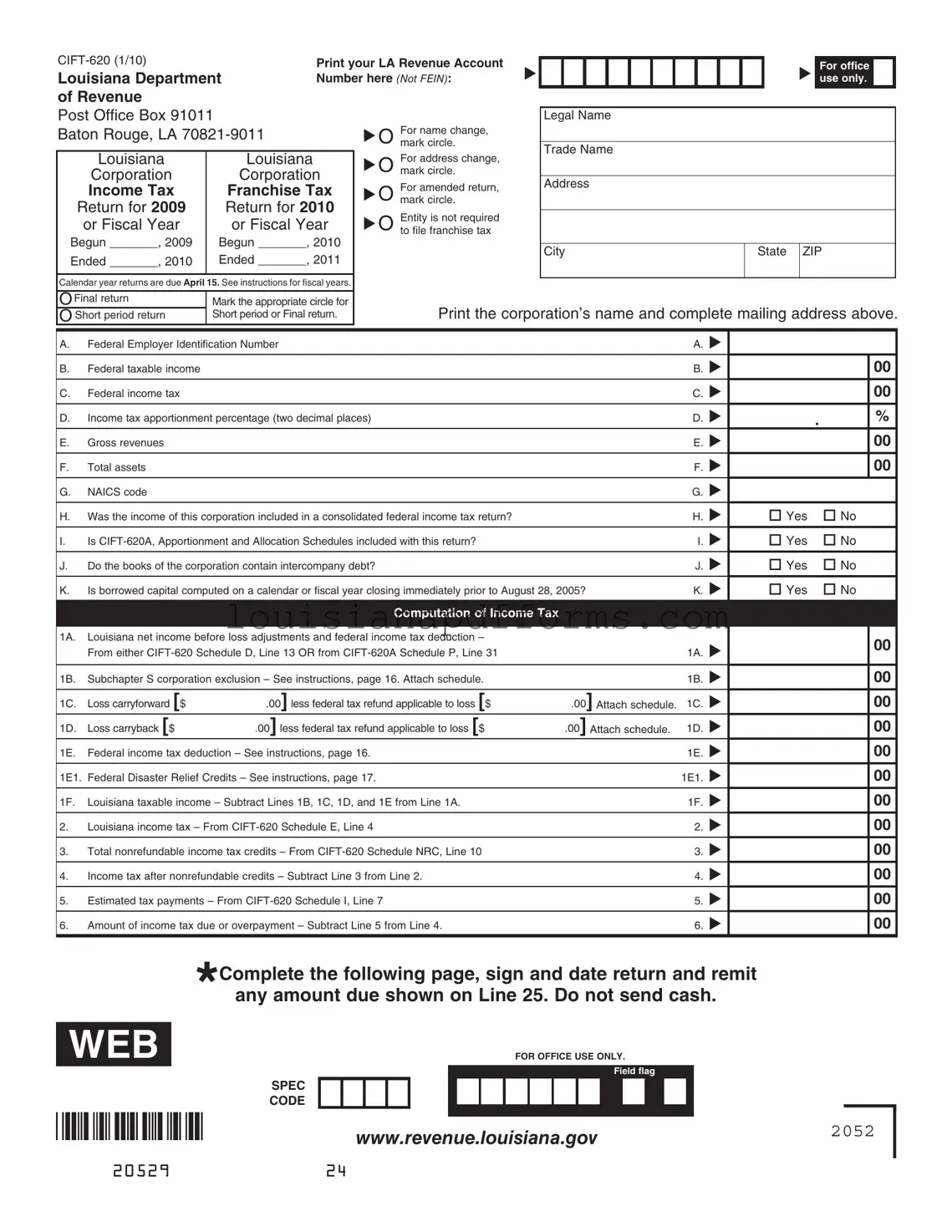

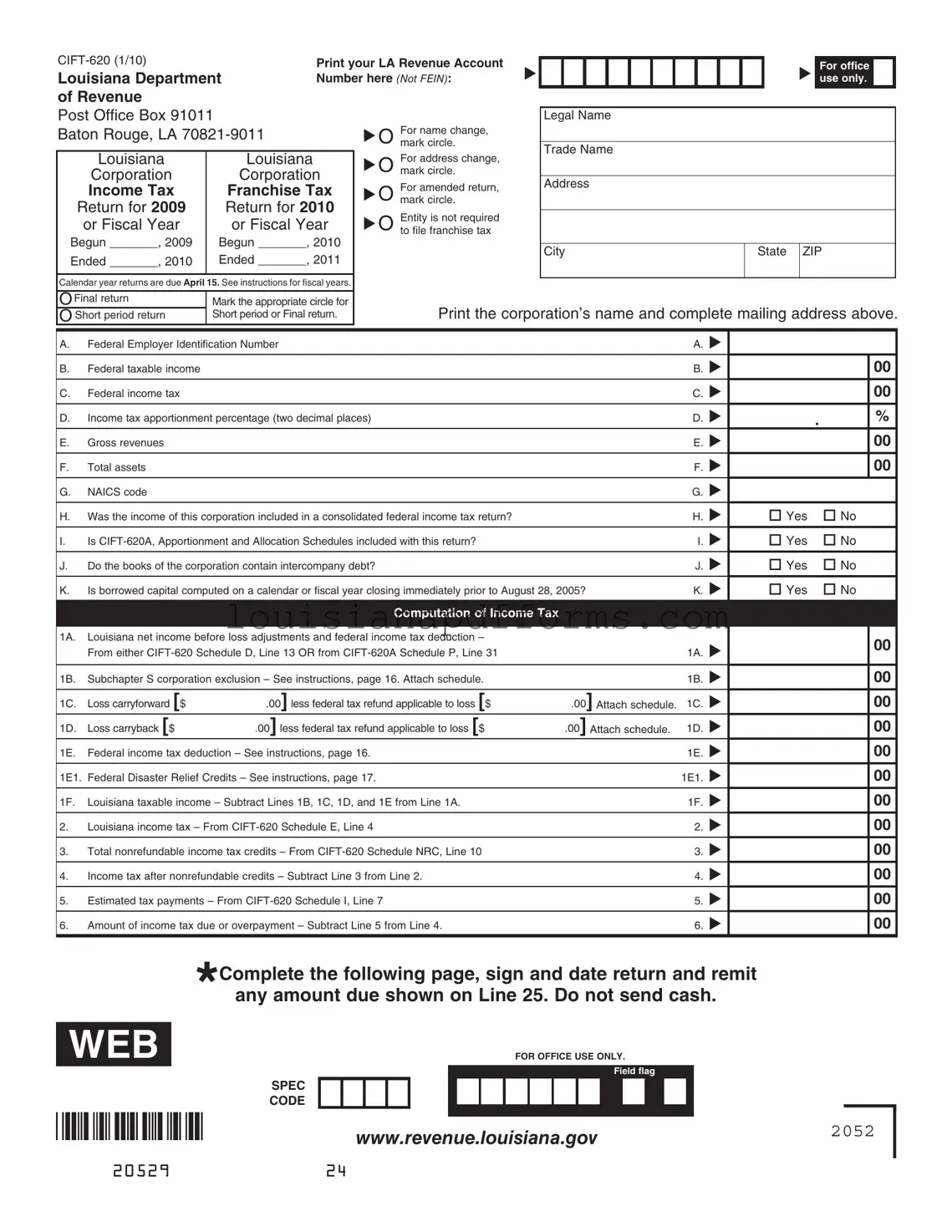

Print your LA Revenue Account Number here. u _____________________________

All applicable schedules must be completed.

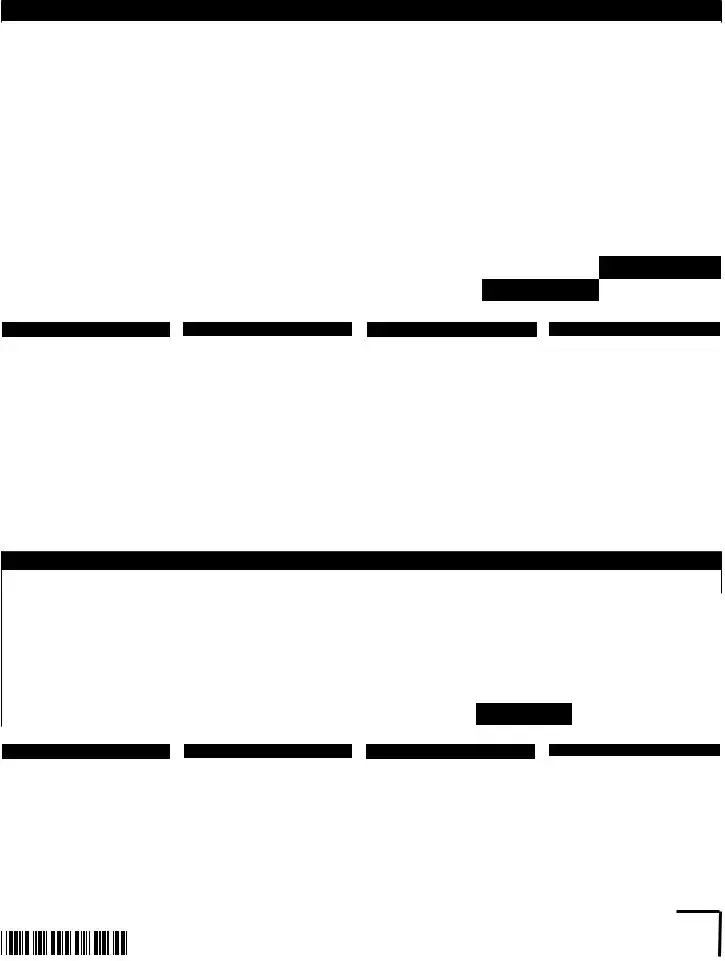

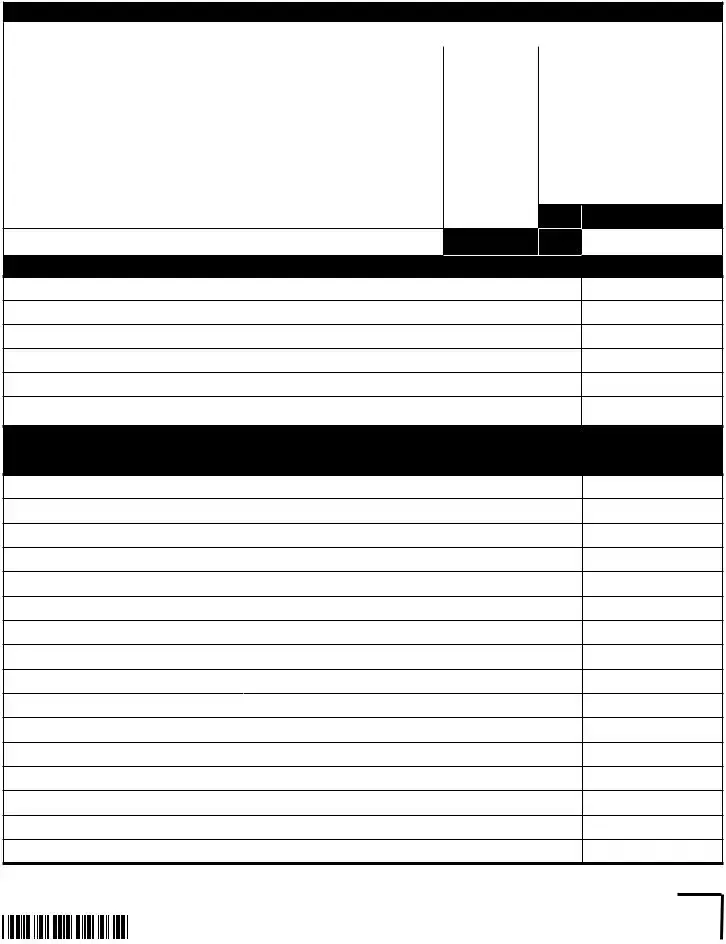

Schedule A – Balance Sheet

ASSETS |

1. Beginning of year |

2. End of year |

1.Cash

2.Trade notes and accounts receivable

3. |

Reserve for bad debts |

( |

) |

( |

) |

4. |

Inventories |

|

|

|

|

|

|

|

|

|

|

5. |

Investment in United States government obligations |

|

|

|

|

|

|

|

|

|

|

6. |

Other current assets – Attach schedule. |

|

|

|

|

|

|

|

|

|

|

7. |

Loans to stockholders |

|

|

|

|

|

|

|

|

|

|

8. |

Stock and obligations of subsidiaries |

|

|

|

|

|

|

|

|

|

|

9. |

Other investments – Attach schedule. |

|

|

|

|

|

|

|

|

|

10. Buildings and other ixed depreciable assets |

|

|

|

|

|

|

|

|

|

11. Accumulated amortization and depreciation |

( |

) |

( |

) |

12. Depletable assets |

|

|

|

|

|

|

|

|

|

13. Accumulated depletion |

( |

) |

( |

) |

14. Land |

|

|

|

|

|

|

|

|

|

15. Intangible assets |

|

|

|

|

|

|

|

|

|

16. Accumulated amortization |

( |

) |

( |

) |

17. Other assets – Attach schedule. |

|

|

|

|

|

|

|

|

|

18. Excessive reserves or undervalued assets – Attach schedule. |

|

|

|

|

|

|

|

|

|

19. Totals – Add Lines 1 through 18. |

|

|

|

|

Liabilities and Capital

20. Accounts payable

21. Mortgages, notes, and bonds payable one year old or less at balance sheet date and having a maturity of one year or less from original date incurred

22. Other current liabilities – Attach schedule.

23. Loans from stockholders – Attach schedule.

24. Due to subsidiaries and affiliates

25. Mortgages, notes, and bonds payable more than one year old at balance sheet date or having a maturity of more than one year from original date incurred

26. Other liabilities – Attach schedule.

27. Capital stock: a. Preferred stock

b. Common stock

28. Paid-in or capital surplus

29. Surplus reserves – Attach schedule.

30. Earned surplus and undivided proits

31. Excessive reserves or undervalued assets

32. Totals – Add Lines 20 through 31.

Print your LA Revenue Account Number here. u _____________________________

For Schedule A-1 see Revenue Information Bulletins (RIB) 05-026 and (RIB) 06-026. Also see Revenue Ruling (RR) 06-010.

All applicable schedules must be completed. Complete lines 1 through 11 only if there is an end of year balance in the “Due to Subsidiaries and Affiliates” account or an equivalent account on the books of the corporation.

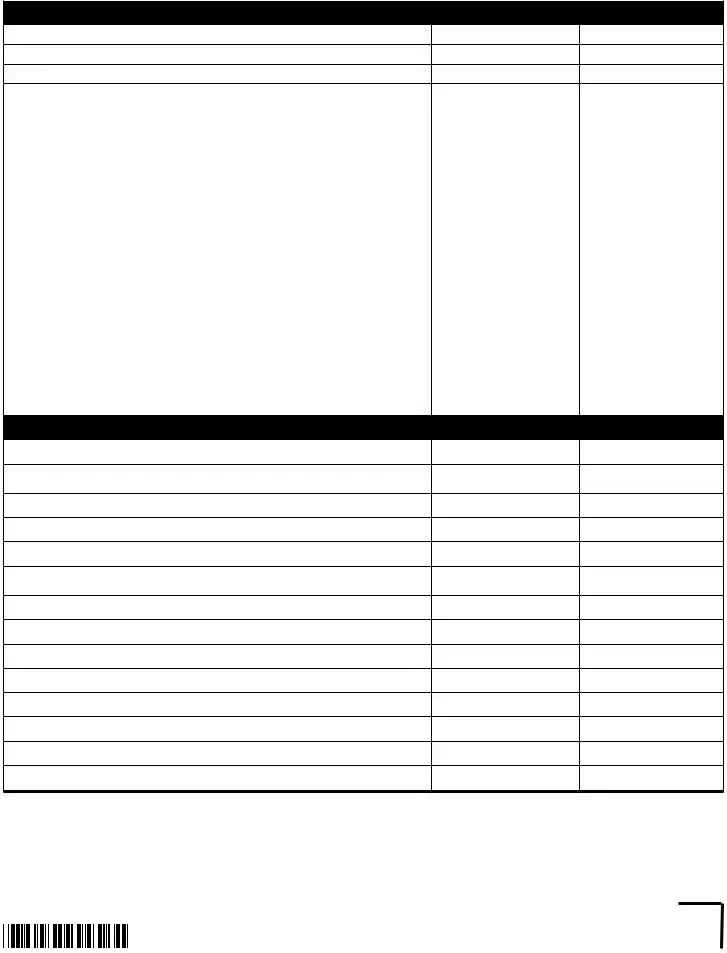

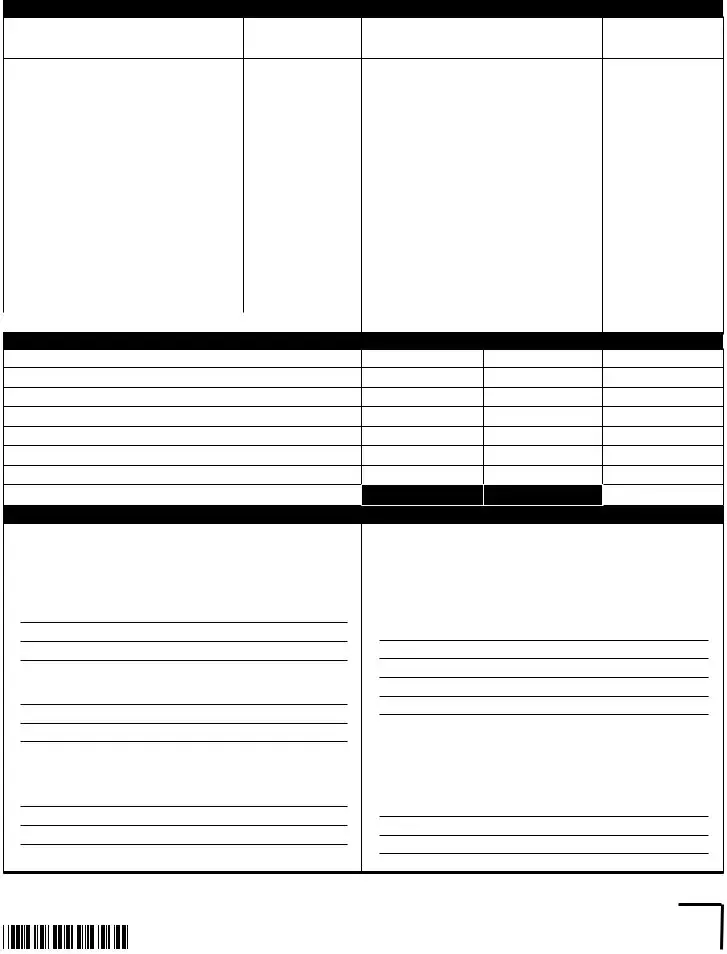

Schedule A-1 Computation of Franchise Tax Base

1. Capital Stock:

1A. |

Common Stock – Include paid-in or Capital Surplus |

|

|

00 |

|

|

|

|

|

1B. |

Preferred Stock – Include paid-in or Capital Surplus |

|

|

00 |

2. Total Capital stock – Add Lines 1A and 1B. |

|

|

00 |

|

|

|

|

3. Surplus and undivided proits |

|

|

00 |

|

|

|

|

4. Surplus reserves – Include any excessive reserves or undervalued assets. |

|

|

00 |

|

|

|

|

5. Total – Add Lines 2, 3, and 4. |

|

|

00 |

|

|

|

|

6. Due to subsidiaries and affiliates |

|

|

00 |

7. Deposit liabilities to affiliates – Included in the amount on Line 6 |

|

|

00 |

|

|

|

|

8. Accounts payable less than 180 days old – Included in the amount on Line 6 |

|

|

00 |

|

|

|

|

9. Adjusted debt to affiliates – Subtract Lines 7 and 8 from Line 6. |

|

|

00 |

|

|

|

10A. If Line 9 above is greater than zero, AND Line 5 above is greater than or equal to zero, subtract Line 5 |

|

00 |

from line 9. If both conditions of this line do not apply, skip to Line 10B. |

|

|

|

|

|

|

|

|

10A1. If Line 10A is less than zero, print zero on Line 11 and Line 24, column 3. If Line 10A is greater than zero, |

|

|

multiply Line 10A by 50% and print this amount on Line 11 and Line 24, column 3. |

|

|

|

|

|

|

10B. If Line 9 is greater than zero, AND Line 5 is less than or equal to zero, subtract Line 5 from Line 9. |

|

00 |

Multiply the difference by 50% and print the result here. |

|

|

|

|

|

10B1. Print the lesser of Line 9 or Line 10B on Line 11 and Line 24, column 3. If Line 9 equals Line 10B, print that |

|

|

amount on Line 11 and on Line 24, column 3. |

|

|

|

11. Print the amount from either Line 10A1 or 10B1. |

|

|

00 |

|

1 |

2 |

3 |

|

|

End of year |

70% reduction |

Total |

|

|

for items of debt |

(See note below.) |

|

|

|

|

|

12.Accounts payable

13.Mortgages, notes and bonds payable one year old or less at balance sheet date and having a maturity of one year or less from original date incurred. – Complete Schedule B. Do Not include indebtedness from the Louisiana Infrastructure Bank.

14.Other current liabilities – Attach Schedule.

Do Not include items of surplus. See RIB 06-026.

15.Loans from stockholders – Attach Schedule.

16.End of year balance due to subsidiaries and affiliates, less amount on Line 11. If less than zero, print zero.

17.Mortgages, notes and bonds payable more than one year old at balance sheet date or having a maturity of more than one year from original date incurred. – Do Not include indebtedness from the Louisiana Infrastructure Bank.

18.Other liabilities – Attach schedule.

Do Not include items of surplus. See RIB 06-026.

19.Capital Stock: Common Stock

|

|

Preferred Stock |

|

|

|

|

|

|

|

|

|

|

20. |

Paid-in or capital surplus – Include items of paid-in capital in excess |

|

|

|

of par value. |

|

|

|

21. |

Surplus reserves – Attach schedule. |

|

|

|

|

|

|

|

|

|

|

22. |

Earned surplus and undivided proits |

|

|

|

|

|

|

|

|

|

|

23. |

Excess reserves or undervalued assets |

|

|

|

|

|

|

|

|

|

|

24. |

Additional surplus and undivided proits – From Line 11 above |

|

|

|

|

|

|

|

|

|

25. Total – Add the amounts in Column 3, Lines 12 through 24. Print the total in |

|

|

|

Column 3 and on CIFT-620 Page 2, Line 7A . Round to the nearest dollar. |

|

Note: Print in Column 1 those items that are included in the franchise taxable base. Multiply Lines 12 through 18 by the percentage |

|

|

of reduction in Column 2. Subtract the result from Column 1 and print the amount in Column 3. |

|

|

|

|

|

|

|

|

|

WEB |

|

2056 |

|

|

|

|

|

|

|

|

|

Print your LA Revenue Account Number here. u _____________________________

All applicable schedules must be completed.

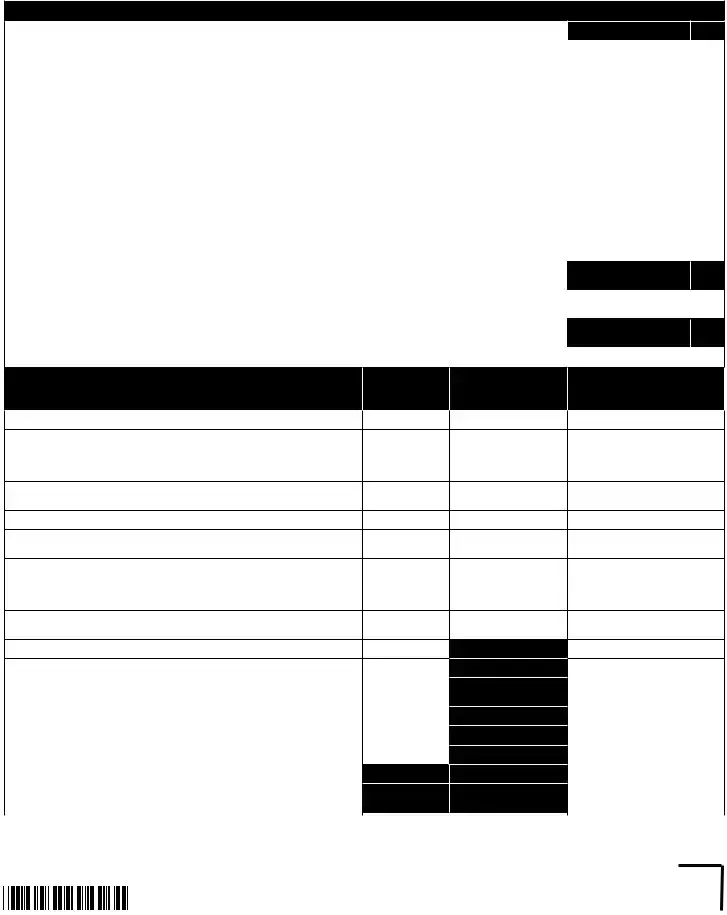

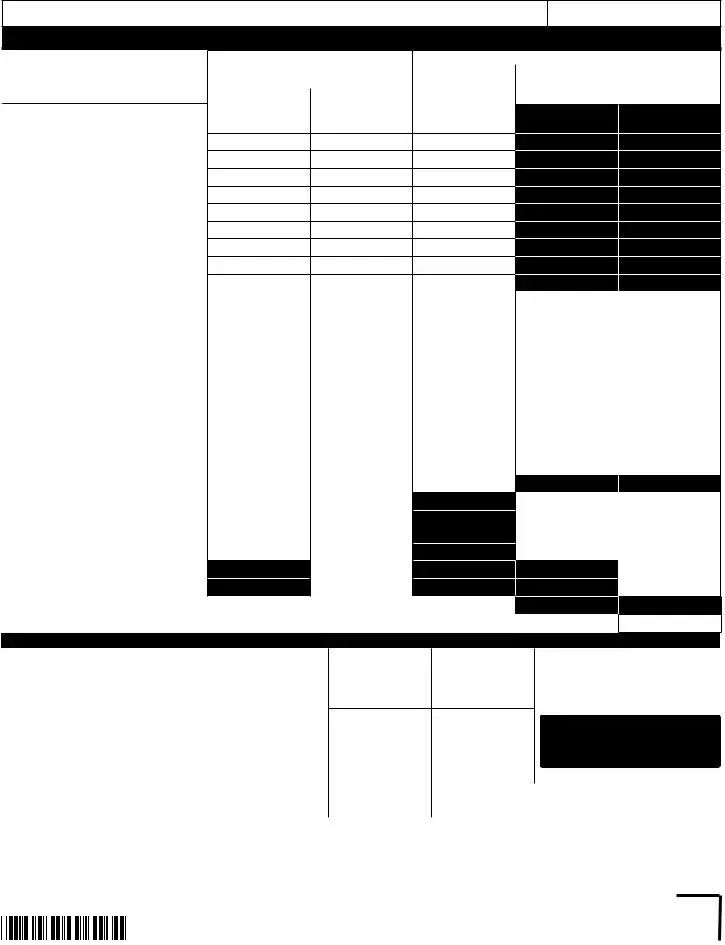

Schedule E – Calculation of Income Tax

|

1. Print the amount of net taxable income from CIFT-620, Page 1, Line 1F. |

|

|

|

|

|

|

|

|

|

|

Column 1 |

|

Column 2 |

|

2. Calculation of tax |

Net income |

RATE |

|

TAX |

|

|

in each bracket |

|

|

|

|

|

|

|

|

|

|

|

a. First $25,000 of net income |

|

x 4% = |

|

|

|

|

|

|

|

b. Next $25,000 |

|

x 5% = |

|

|

|

|

|

|

|

c. Next $50,000 |

|

x 6% = |

|

|

|

|

|

|

|

d. Next $100,000 |

|

x 7% = |

|

|

|

|

|

|

|

e. Over $200,000 |

|

x 8% = |

|

|

|

|

|

|

3.Add the amounts in Column 1, Lines 2a through 2e and print the result.

4.Add the amounts in Column 2, Lines 2a through 2e. Round to the nearest dollar. Print in Column 2 and on CIFT-620, Page 1, Line 2.

Schedule F – Calculation of Franchise Tax

1.Print the amount from CIFT-620, Page 2, Line 7 or Line 8, whichever is greater.

2.Print the amount of Line 1 or $300,000, whichever is less.

3.Multiply the amount on Line 2 by $1.50 for each $1,000 or major fraction and print the result.

4.Subtract Line 2 from Line 1 and print the result.

5.Multiply the amount on Line 4 by $3.00 for each $1,000 or major fraction and print the result.

6.Add Lines 3 and 5. Round to the nearest dollar. Print the result here and on CIFT-620, Page 2, Line 9.

Schedule G – Reconciliation of Federal and Louisiana Net Income

Schedule G is required if Form CIFT-620A, Apportionment and Allocation Schedules are iled with this return.

Important! See R.S. 47:287.71 and R.S. 47:287.73 for information.

1.Print the total net income calculated under federal law before special deductions.

2.Additions to federal net income: a. Louisiana income tax

b.

c.

d.

e.

f.

Subtractions from federal net income:

a.Dividends

b.Interest

c.Road Home – The amount included in federal taxable income

3.Louisiana net income from all sources – The amount should agree with Form CIFT-620A, Schedule P, Line 26.

Print your LA Revenue Account Number here. u _____________________________

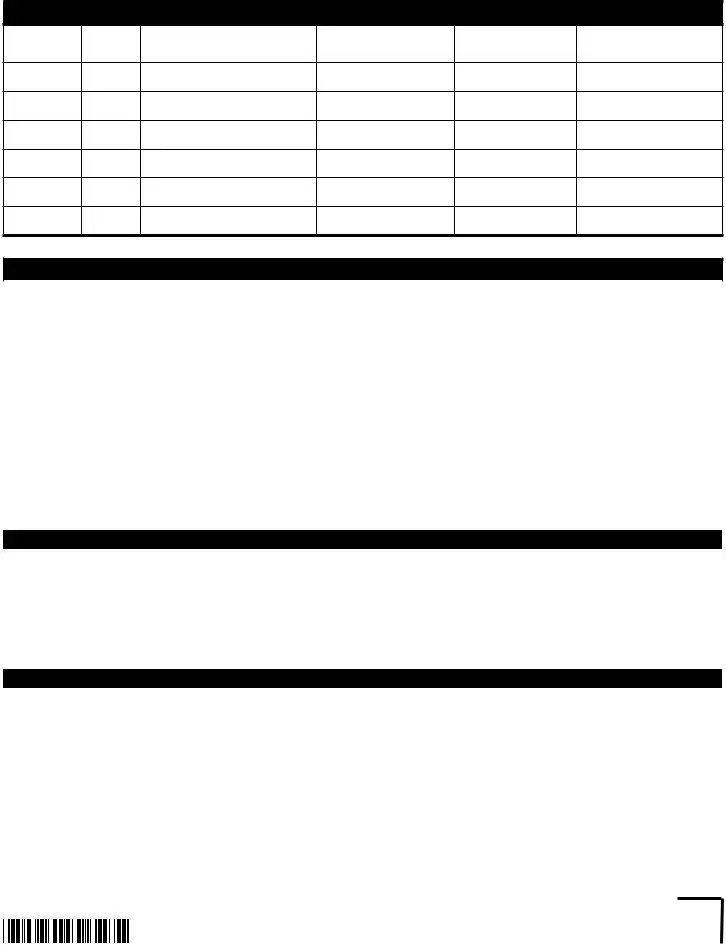

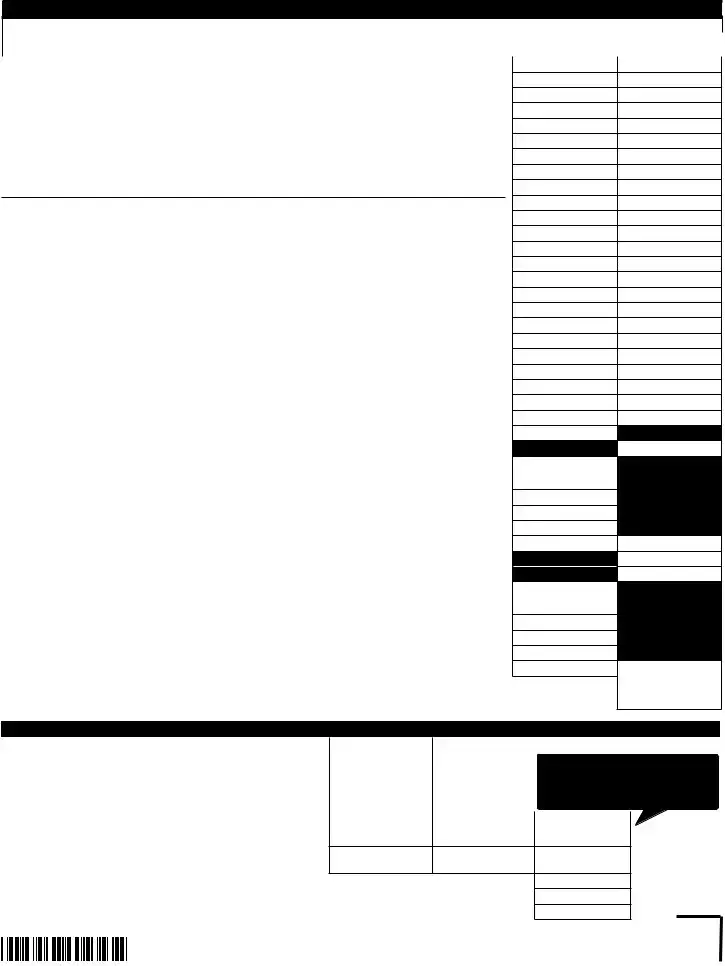

Schedule P - Computation of Louisiana Net Income

Column 3 must be completed. Column 2 must also be completed if the separate accounting method is used.

|

Those corporations employing the separate accounting method should review R.S. 47:287.94H for guidance. |

2. LA amounts |

3. Totals |

|

1. Items |

(Lines 1 through 25) |

|

|

1.Gross receipts ______________________ Less returns and allowances _______________

2.Less: Cost of goods sold and/or operations – Attach schedules. ........................................................................

3.Gross proit ...........................................................................................................................................................

4.Gross rents ...........................................................................................................................................................

5.Gross royalties ......................................................................................................................................................

6.Income from estates, trusts, partnerships.............................................................................................................

7.Income from construction, repair, etc. ..................................................................................................................

8.Other income – Attach schedule. .........................................................................................................................

9.Total income – Add Lines 3 through 8.............................................................................................................................................

10. Compensation of officers .....................................................................................................................................

11. Salaries and wages (not deducted elsewhere).....................................................................................................

12. Repairs – Do not include cost of improvements or capital expenditures. ............................................................

13. Bad debts..............................................................................................................................................................

14. Rent ......................................................................................................................................................................

15. Taxes – Attach schedule. .....................................................................................................................................

16. Interest ..................................................................................................................................................................

17. Contributions.........................................................................................................................................................

18.Depreciation – Attach schedule. ...........................................................................................................................

19.Depletion – Attach schedule. ................................................................................................................................

20.Advertising ............................................................................................................................................................

21.Pension, proit sharing, stock bonus, and annuity plans ......................................................................................

22.Other employee beneit plans...............................................................................................................................

23.Other deductions – Attach schedule.....................................................................................................................

24.Total deductions – Add Lines 10 through 23........................................................................................................

25.Net income from Louisiana sources – If separate (direct) method of reporting is used, print here and on Line 31.

26.Net income from all sources – Subtract Column 3, Line 24 from Column 3, Line 9. ..........................................

27.Allocable income from all sources – See instructions, page 25. Attach schedule supporting each amount.

A.Net rents and royalties from immovable or corporeal movable property .........................................................

B.Royalties from the use of patents, trademarks, etc. – See instructions, page 25............................................

C.Income from estates, trusts, and partnerships .................................................................................................

D.Income from construction, repair, etc. – See instructions, page 25.................................................................

E.Other allocable income.......................................................................................................................................

28.Net income subject to apportionment – Subtract Lines 27A through 27E from Line 26, Column 3. ...................

29.Net income apportioned to Louisiana – See instructions, page 25. .....................................................................

30.Allocable income from Louisiana sources – See instructions, page 26. Attach schedule supporting each amount.

A.Net rents and royalties from immovable or corporeal movable property .........................................................

B.Royalties from the use of patents, trademarks, etc. – See instructions, page 26............................................

C.Income from estates, trusts, and partnerships .................................................................................................

D.Income from construction, repair, etc. – See instructions, page 26.................................................................

E.Other allocable income.....................................................................................................................................

31.Louisiana net income before loss adjustments and federal income tax deduction –

Add Column 3, Line 29 to Column 2, Lines 30A through 30E. Print the result or the amount on Line 25,

whichever is applicable, here and on Form CIFT-620, Page 1, Line 1A. Round to the nearest dollar. .....................................................

Schedule Q - Computation of Income Tax Apportionment Percentage

1. Description of items used as ratios |

2. Total amount 3. Louisiana amount |

4. Percent (Col. 3 ÷ Col. 2) |

1. Net sales of merchandise and/or charges for services |

|

For Manufacturers or Merchandisers. |

A. Sales – See instructions, page 26 |

|

This is your apportionment ratio. Use this |

|

result in determining income apportioned |

B. Charges for services – See instructions, page 26 |

|

|

to Louisiana on Line 29, Sch. P above. Do |

C. Other gross apportionable income |

|

NOT proceed further. |

|

|

|

D.Total – Add the amounts in Columns 2 and 3. Calculate the ratio and print the result in Column 4. For taxpayers whose primary business is manufacturing

or merchandising, use this apportionment ratio. See instructions, page 26 |

__ __ __ . __ __ % |

2.Wages, salaries, and other personal service compensation paid

|

during the year – Print the amounts in Column 2 and Column 3. |

|

|

|

__ __ __ . __ __ % |

|

Calculate the ratio and print the result in Column 4 |

|

3. |

Income tax property ratio – Print percentage from Schedule M, Line 27 |

__ __ __ . __ __ % |

4. |

Total of percents in Column 4 |

__ __ __ . __ __ % |

5. Average of percents – Multiply this result by the amount on Schedule P, Line 29 to determine the amount of Louisiana apportionable income. |

__ __ __ . __ __ % |

|

WEB |

|

|

|

2061 |