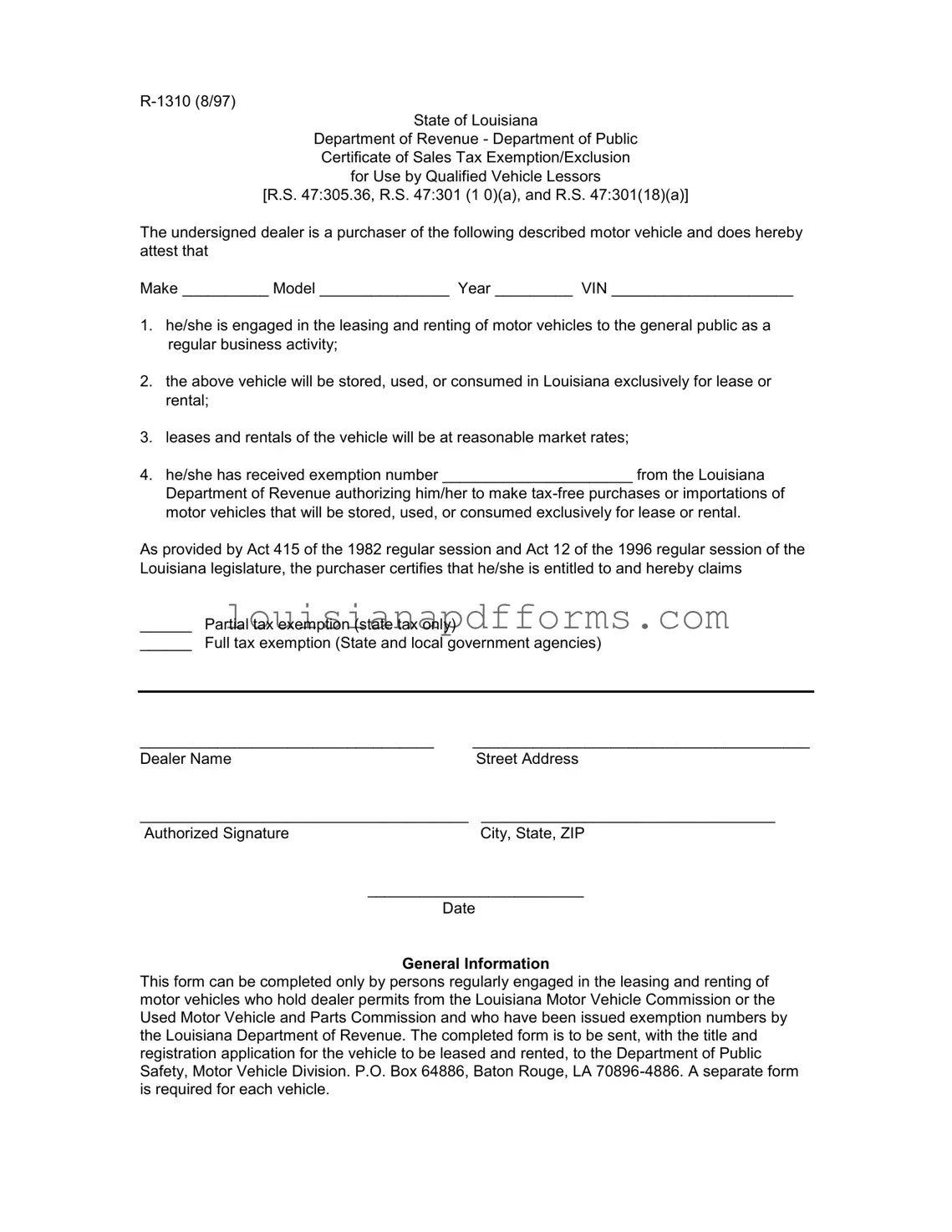

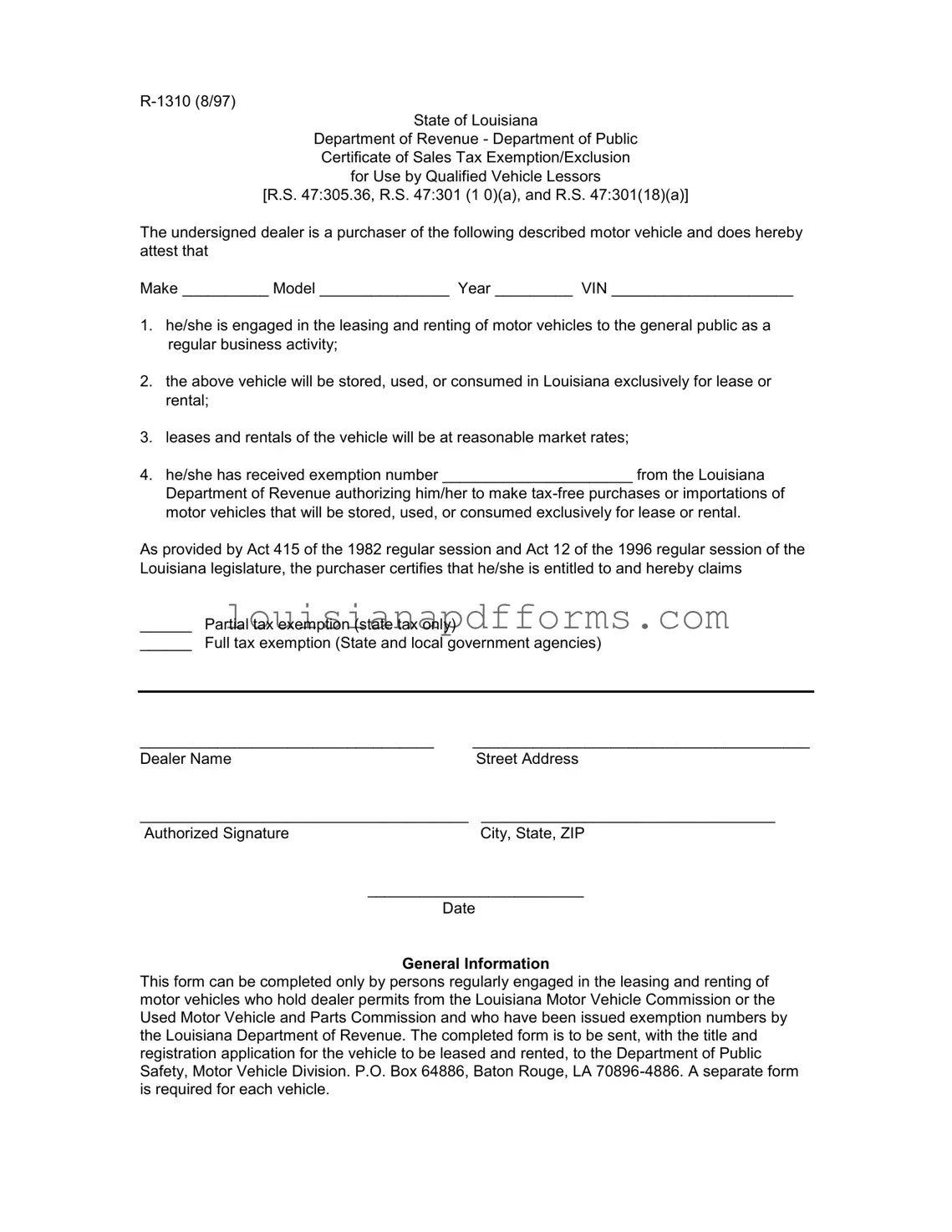

Blank Louisiana R 1310 PDF Form

The Louisiana R 1310 form serves as a Certificate of Sales Tax Exemption/Exclusion specifically for qualified vehicle lessors. This form allows dealers engaged in the leasing and renting of motor vehicles to certify their eligibility for tax-free purchases. To utilize this exemption, dealers must hold the necessary permits and exemption numbers issued by the Louisiana Department of Revenue.

Access My Document Now

Blank Louisiana R 1310 PDF Form

Access My Document Now

Access My Document Now

or

Free Louisiana R 1310

You’re halfway through — finish the form

Edit, save, and download your completed Louisiana R 1310 online.