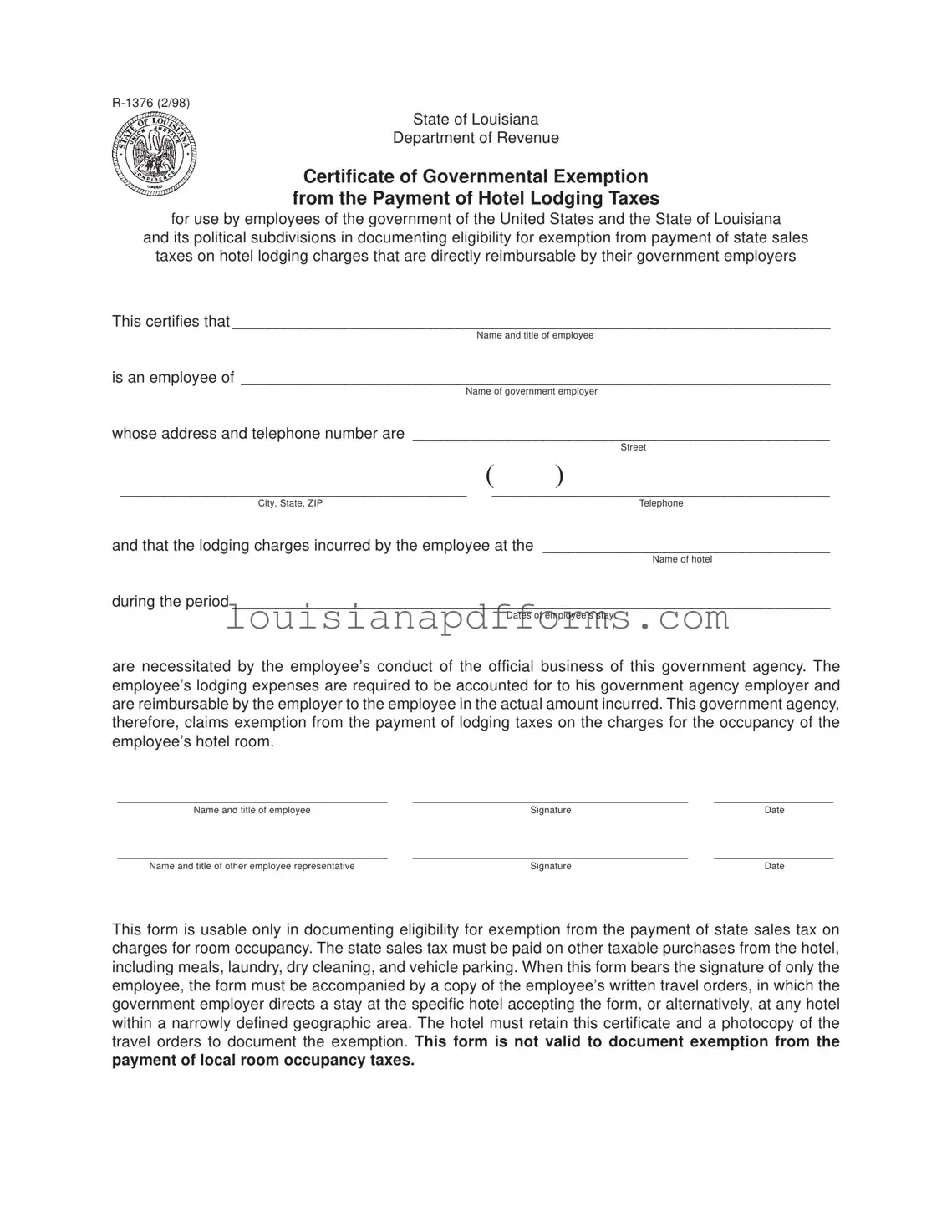

Blank Louisiana R 1376 PDF Form

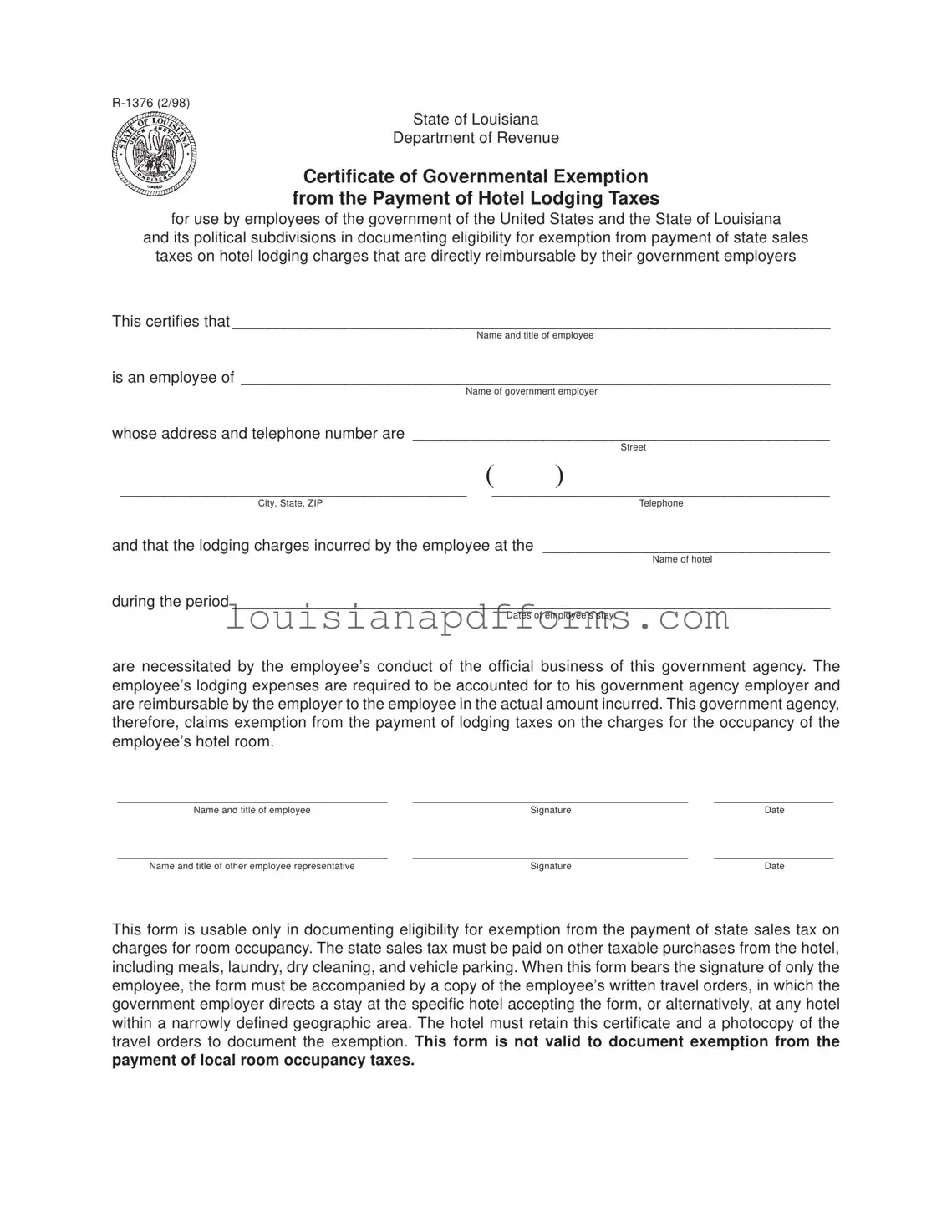

The Louisiana R 1376 form serves as a Certificate of Governmental Exemption from the Payment of Hotel Lodging Taxes. This document is specifically designed for employees of the United States government and the State of Louisiana, allowing them to document their eligibility for exemption from state sales taxes on hotel lodging charges that are reimbursable by their employers. By utilizing this form, government employees can ensure compliance while conducting official business, ultimately easing the financial burden associated with lodging expenses.

Access My Document Now

Blank Louisiana R 1376 PDF Form

Access My Document Now

Access My Document Now

or

Free Louisiana R 1376

You’re halfway through — finish the form

Edit, save, and download your completed Louisiana R 1376 online.