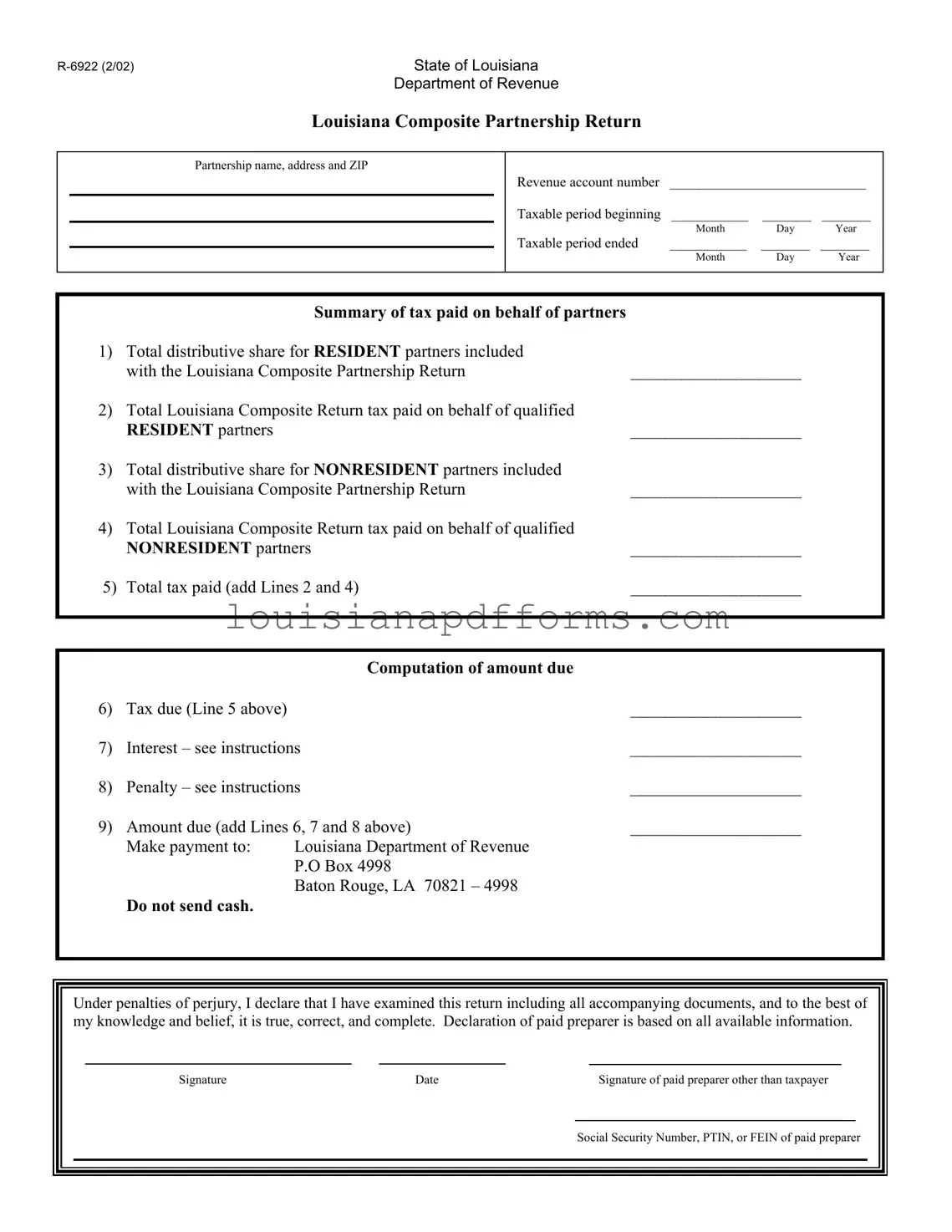

The Louisiana R 6922 form is a tax return specifically designed for partnerships operating in Louisiana. It allows partnerships to report income and taxes on behalf of both resident and nonresident partners. By filing this form, partnerships can simplify their tax obligations, ensuring that the appropriate taxes are paid on behalf of their partners. This form is particularly useful for partnerships that want to streamline their tax reporting process while complying with state tax laws.

Any partnership that has partners who are residents or nonresidents of Louisiana may need to file the R 6922 form. If the partnership earns income that is subject to Louisiana state taxes, it is essential to report that income accurately. Additionally, partnerships that choose to pay taxes on behalf of their partners, rather than requiring individual partners to file separately, must use this form. This filing helps ensure that all tax obligations are met efficiently.

The R 6922 form requires several key pieces of information, including:

-

The partnership's name, address, and revenue account number.

-

The taxable period for which the return is being filed, including start and end dates.

-

A summary of tax paid on behalf of both resident and nonresident partners.

-

Calculations for total tax due, including any interest or penalties.

-

Signatures from both the taxpayer and the paid preparer, if applicable.

Providing accurate and complete information is crucial to avoid delays or issues with the filing process.

Tax calculation on the R 6922 form involves several steps. First, partnerships must determine the total distributive share for both resident and nonresident partners. This includes calculating the total tax paid on behalf of qualified partners. Once these amounts are known, the partnership adds the tax amounts for resident and nonresident partners to find the total tax due. Additional considerations, such as interest and penalties, may also apply, which must be added to the total amount due. The final amount represents what the partnership must pay to the Louisiana Department of Revenue.

Once the R 6922 form is completed, it should be mailed to the Louisiana Department of Revenue. The appropriate mailing address is:

P.O. Box 4998

Baton Rouge, LA 70821 – 4998

It is important to note that cash should not be sent with the form. Partnerships should ensure that the form is submitted by the appropriate deadline to avoid any potential penalties or interest charges.