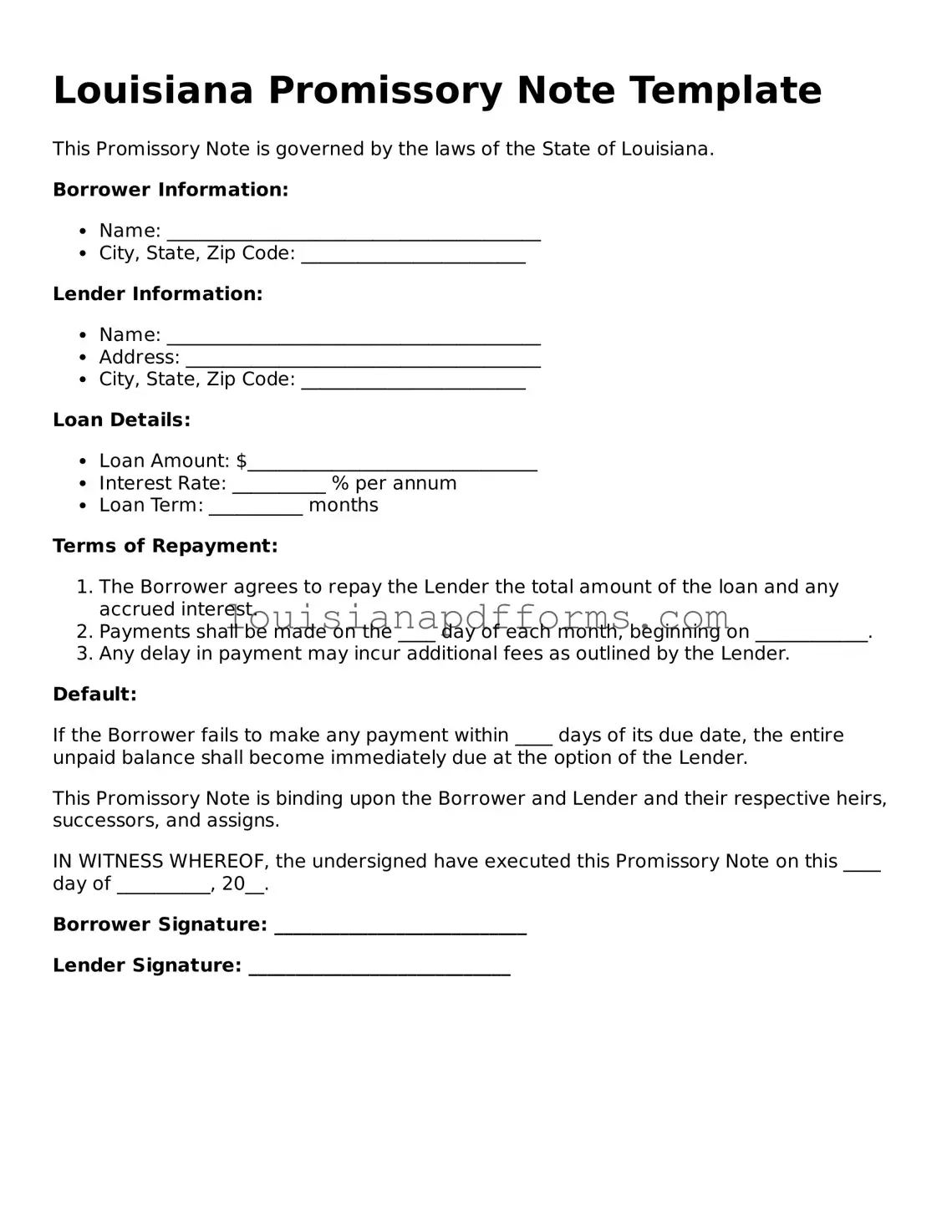

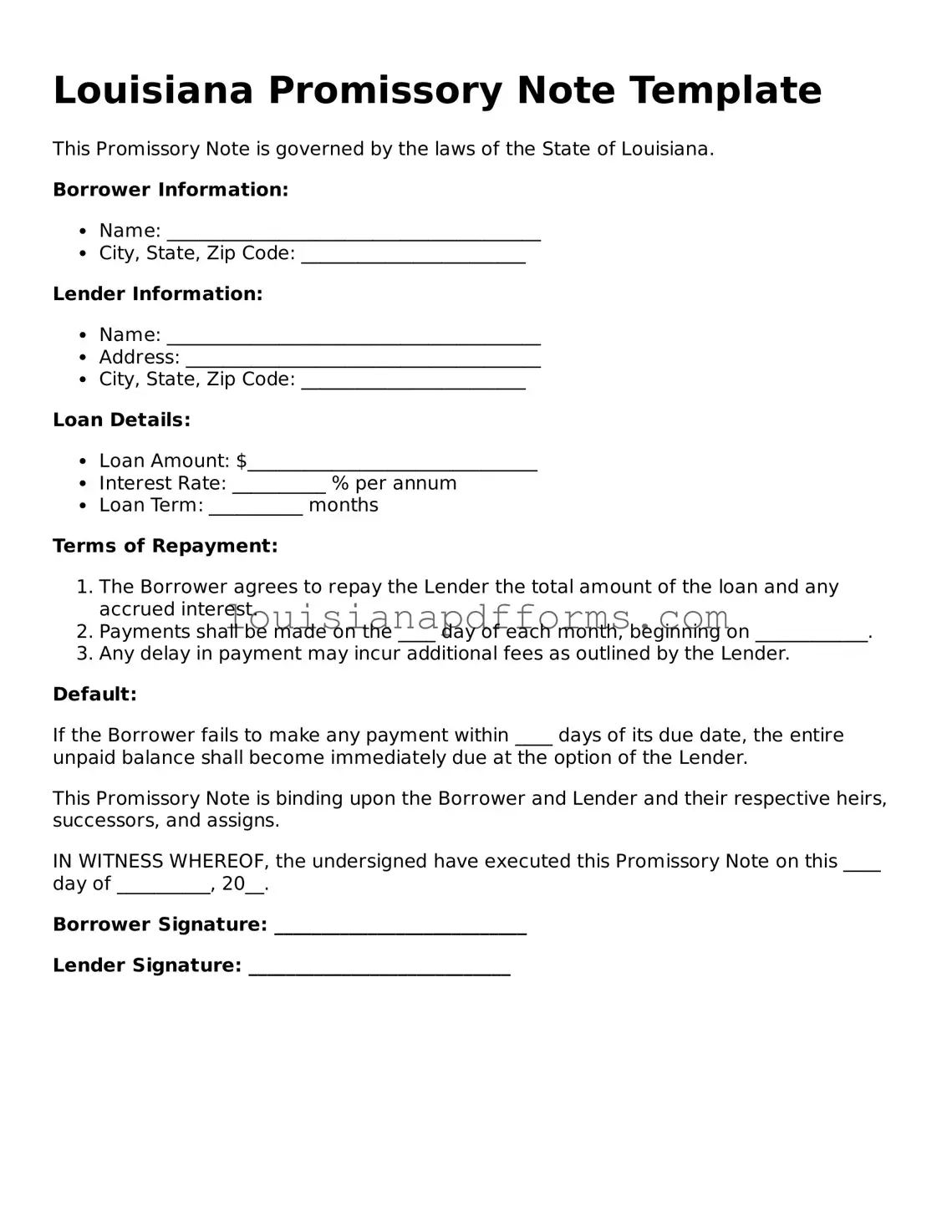

Louisiana Promissory Note Form

A Louisiana Promissory Note is a written promise to pay a specific amount of money to a designated party at a defined time or on demand. This financial document serves as a crucial tool for individuals and businesses alike, ensuring clarity in lending and borrowing agreements. Understanding its components can help you navigate financial transactions with confidence.

Access My Document Now

Louisiana Promissory Note Form

Access My Document Now

Access My Document Now

or

Free Promissory Note

You’re halfway through — finish the form

Edit, save, and download your completed Promissory Note online.