Blank R 1042 Louisiana Certificate PDF Form

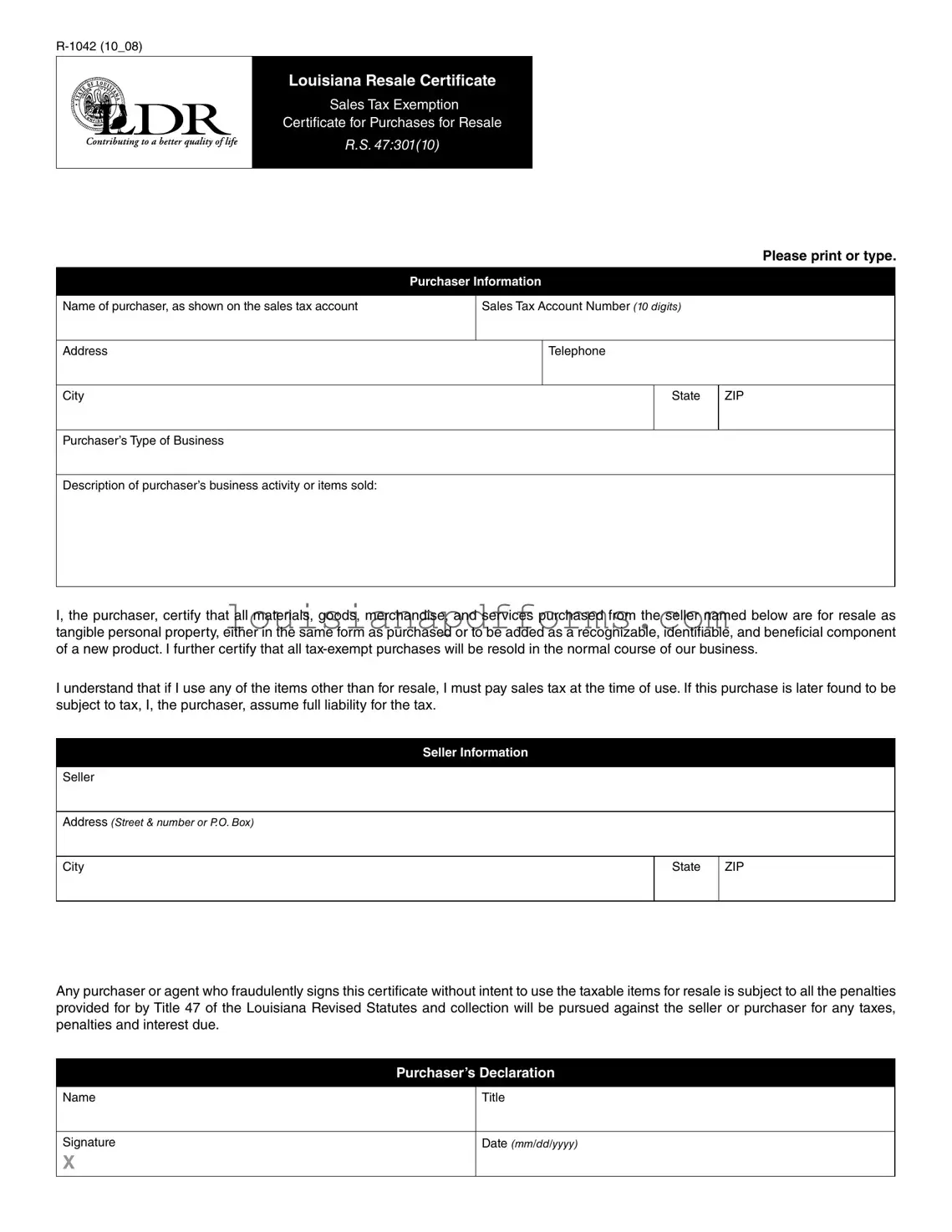

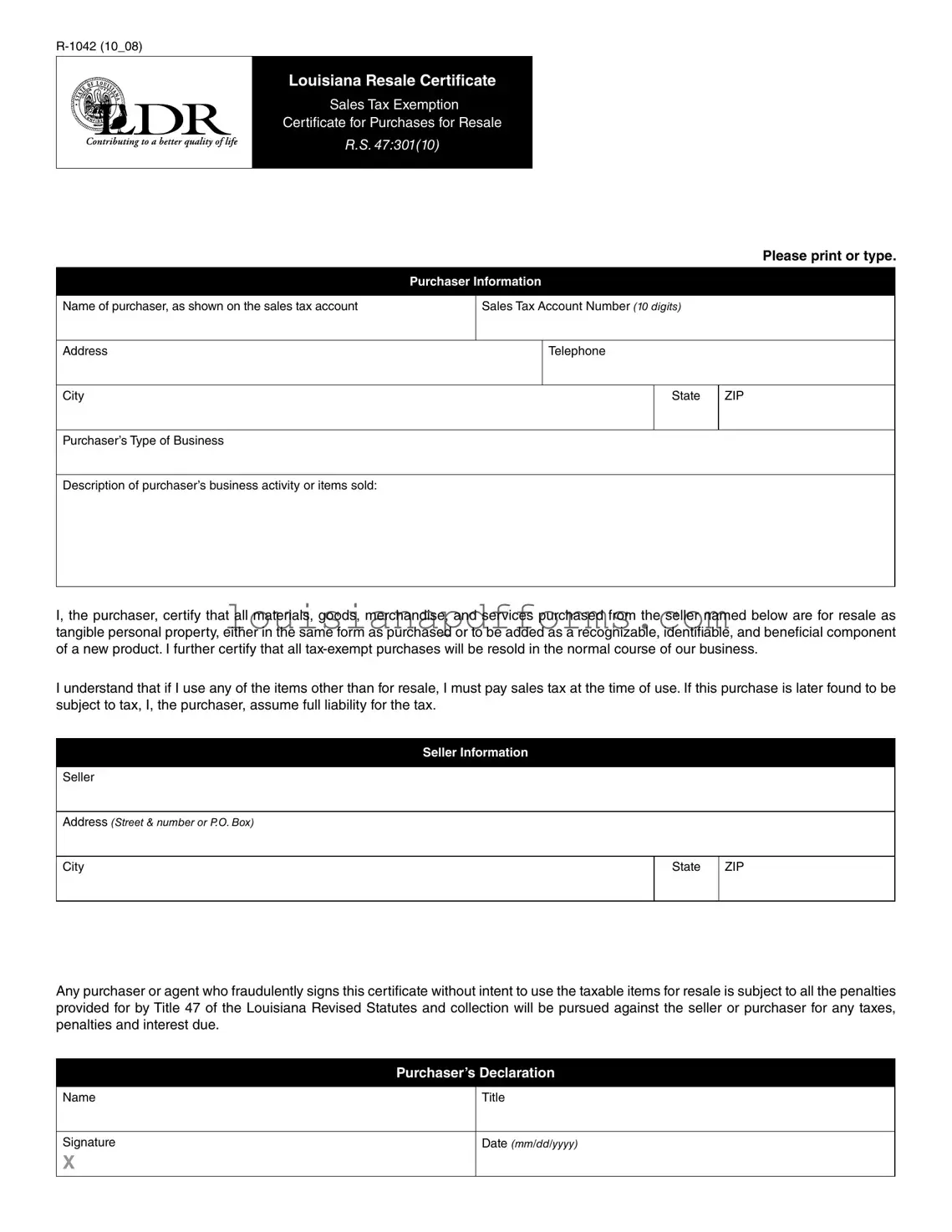

The R 1042 Louisiana Certificate is a sales tax exemption certificate used for purchases intended for resale. This form allows businesses to certify that the items they buy are not for personal use, but rather for resale in their normal operations. Understanding how to properly fill out this form can help ensure compliance with Louisiana tax regulations and avoid unnecessary tax liabilities.

Access My Document Now

Blank R 1042 Louisiana Certificate PDF Form

Access My Document Now

Access My Document Now

or

Free R 1042 Louisiana Certificate

You’re halfway through — finish the form

Edit, save, and download your completed R 1042 Louisiana Certificate online.