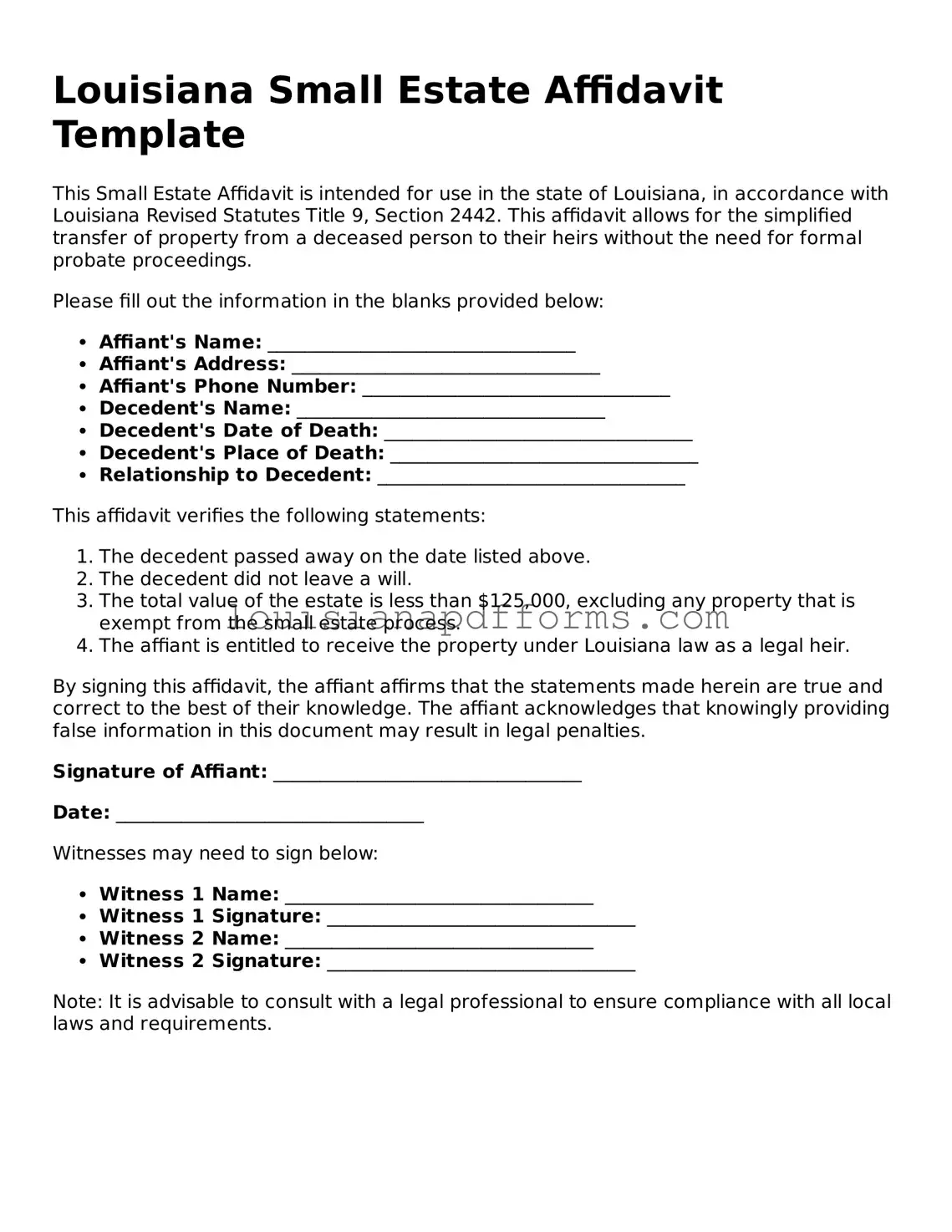

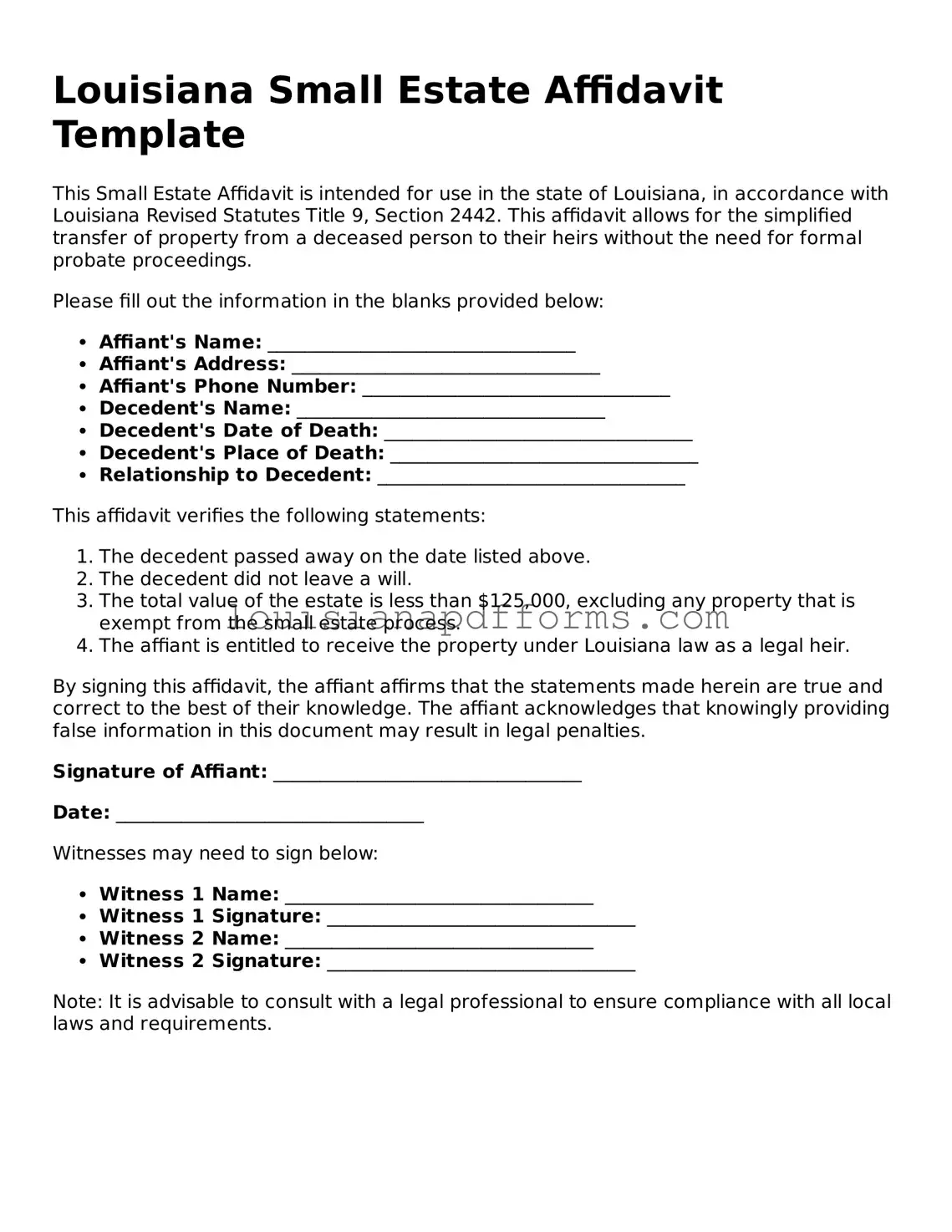

Louisiana Small Estate Affidavit Form

The Louisiana Small Estate Affidavit is a legal document that allows individuals to settle the estate of a deceased person without going through the full probate process. This form simplifies the transfer of assets when the total value of the estate is below a certain threshold. It provides a straightforward way for heirs to claim their inheritance efficiently and with minimal court involvement.

Access My Document Now

Louisiana Small Estate Affidavit Form

Access My Document Now

Access My Document Now

or

Free Small Estate Affidavit

You’re halfway through — finish the form

Edit, save, and download your completed Small Estate Affidavit online.